The global notebook market increased from 158 million units in 2019 to 247 million in 2021, thanks to the work-from-home demand, and it will not be easy to surpass the 200 million-unit mark again after 2022.

We can have a glimpse of the Chinese economy by looking at Taiwanese component makers' shipments destined for China's handset and server sectors. The US still dominates the global semiconductor industry and Taiwan is only one link in the supply chain.

Moreover, the focus of the global ICT supply chain is shifting from PCs and handsets to electric vehicles (EV), and this is the "big picture." Underlying the US-China trade war is a hegemonic battle for dominance - this is of course the "big picture." And when you know what the big picture looks look, how can you rely on others?

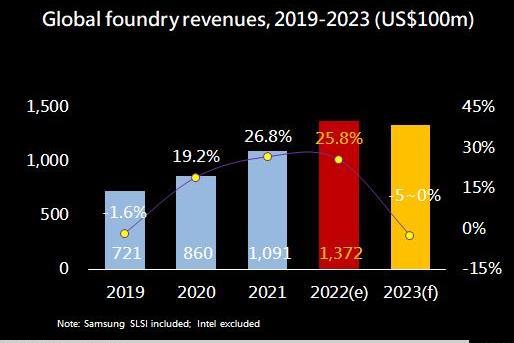

According to findings by DIGITIMES Research, the global foundry market will reach US$137.2 billion in 2022, up 25.8% from 2021, but may experience a mild decline of less than 5% in 2023. We can see from the layoffs and unpaid leaves at GlobalFoundries and Intel that there may be a small downturn in the semiconductor industry for one to two years.

In the long run, the demand for semiconductors will not decrease. "If you know when and where the war will take place, you can travel a thousand miles to meet your enemies." You have to make preparations right now and target the business opporunities beyond 2025. While the US is providing abundant resources seeking to rebuild its supply chains that it can rely on to maintain its economic and political hegemony, we must also understand that one should "avoid taking on soldiers in high morale or taking the bait of the enemy."

Can the US really rebuild a meaningful supply chain?

Young people in Europe and the US may not like working at assembly lines that require repetitive work. Taiwan places its top talent in the management and R&D of semiconductor processes, which makes it hard for TSMC to build R&D teams with thousands of people in other countries in the way it has in Taiwan. In fact there is no need to do so. Perhaps it is just like the time when Taiwan makers moved their notebook plants to China: you follow the path that takes you to the resources.

Secondly, the decentralization of production systems is accelerating. China's zero-COVID policy and lockdowns have further weakened the globally centralized supply chain. And the business opportunities of future cars and Internet of Things (IoT) involve many local services. Apart from the US, will India, Germany and Japan - the three countries projected to be the world's third to fifth largest in GDP rankings in 2030 - do nothing as far as the semiconductor industry is concerned?

Germany and Japan need semiconductors for their automobile industries, and India will definitely establish the necessary environments for developing its own semiconductor industry. They will definitely seek to team up with Taiwan, the global powerhouse in the semiconductor industry. Is Taiwan going to reject them or negotiate the best possible deals with them during the downturn in the next two years?

Will this uproot Taiwan? Many people are talking about the possibility of "de-Taiwanization," but Tsung-Tsong Wu, minister of the National Science and Technology Council, said de-Taiwanization won't be an issue in the next 10 years. So far, more than 90% of the global foundry capacity is in Asia, about 8% in the US, and only 1% in Europe.

Judging from the industry ecosystem and customers' demand for capacity and cost concerns, it is difficult to relocate core business capabilities to the US in the next 10 years. But we still have to deal with both long-term and short-term problems. Taiwan's semiconductor industry will not "maximize" production scales, but rather "optimize" production facility deployments to meet the needs of different regions and industries, and even geopolitical interests.

Source: DIGITIMES Research, November 2022