As the US is spending tens of billions in attracting investments to solidify its leadership in the global semiconductor ecosystem, analysts forecast the US and its European allies will benefit from industrial policy, with TSMC and Samsung Electronics expected to be less of a duopoly in the foundry business.

Yole Intelligence posits the US' control over its semiconductor production will increase by 2028, thanks to its strategies focusing on re-shoring and friend-shoring.

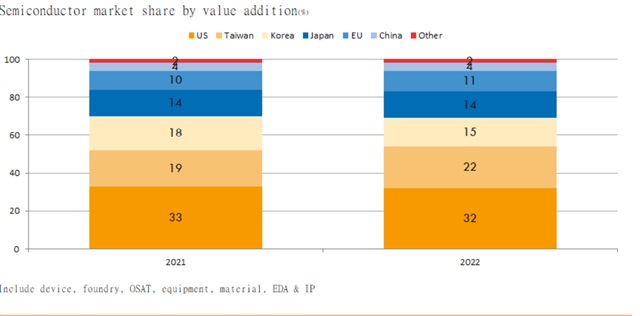

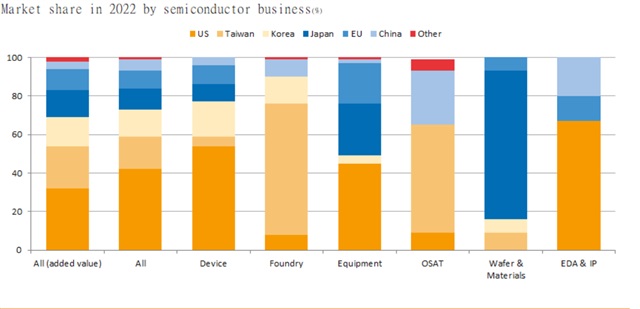

According to data compiled by Yole Intelligence, the US expanded its market share in the global semiconductor device market from 51% in 2021 to 53% in 2022, and Taiwan saw its market share drop from 22% to 18% for the same period.

Yole Intelligence forecasts that as other semiconductor manufacturers, such as Intel, GlobalFoundires, UMC, and SK Hynix, are looking to capitalize on subsidies that governments provide and diversify their production, TSMC and Samsung may not be a duopoly in the global foundry market.

Stephen Rothrock, founder and CEO of ATREG, said that GlobalFoundries is expected to increase its market share in the US, Europe, and Singapore, thanks to the incentives on offer that may be seen once in a decade.

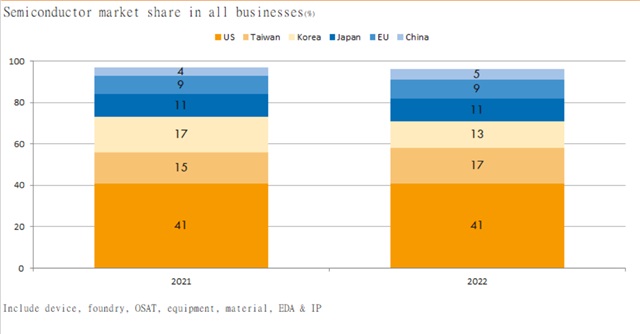

Meanwhile, the data shows for the overall semiconductor value chain that includes upstream to downstream suppliers, Taiwan expanded its market share from 15% in 2021 to 17% in 2022, and China's market share increased by one percentage point.

Still, Yole Intelligence said over the next five years, the semiconductor production capacity will expand in the US and EU, which provides high subsidies to US-based companies, such as Intel. The report added that the EU would gain more secure semiconductor supplies but would not own them as the manufacturers are from the US and Asia.

In late June, Intel and the German government reached an agreement in which Intel would raise its investments in the German wafer fab to EUR 30 billion, with the German government agreeing to increase its subsidy level to EUR 9.9 billion.

The Biden administration unveiled the US$52.7 billion Chips Act to rebuild the US's leadership in the semiconductor ecosystem. On June 23, the US agreed to broaden eligibility for federal subsidies under the act to include semiconductor equipment and materials suppliers. Gina Raimondo, the US commerce secretary, said that the US needs the chemicals, materials, and tools that go into these fabs.

Financial Times reported that European countries are dissatisfied with the new US industrial policy. The report quoted Jens Sudekum, professor of international economics at Dusseldorf's Heinrich Hein University, saying that the US is actively offering subsidies to encourage manufacturers of hydrogen, batteries, and semiconductors to invest there, and Europe has no choice but to follow suit.

Source: Yole Intelligence, July 2023

Source: Yole Intelligence, July 2023

Source: Yole Intelligence, July 2023

Source: Yole Intelligence, July 2023