In 2008, the subprime mortgage crisis and the global financial crisis not only reshaped the financial industry but also had profound effects on the semiconductor sector. Since then, Taiwan and South Korea, particularly TSMC and Samsung, have pursued a proactive strategy, investing heavily to strengthen their lead over competitors. China gained more confidence since the 2008 Beijing Olympics. In 2009, China even surpassed Japan to become the world's second-largest economy by GDP. Boosted by the demand for supercomputers and its military industry, China also accelerated the development of its semiconductor industry.

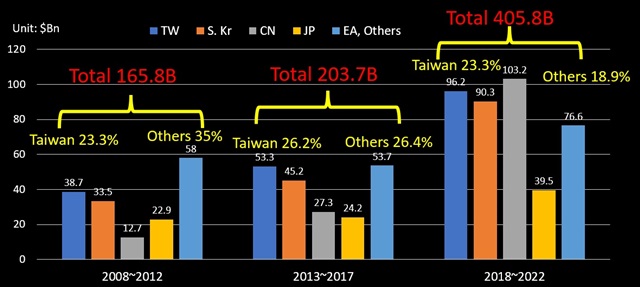

Consequently, the global semiconductor equipment market witnessed remarkable growth. Over the past 15 years, divided into three stages (2008–2012, 2013–2017, and 2018–2022), the market size accumulated $165.8 billion in the first five-year span, $203.7 billion in the second, and an astonishing $405.8 billion in the third. The launch of Apple's iPhone in 2007 marked the beginning of a new era of intelligent applications, demanding more powerful application processors.

The Asia Pacific "Big 4" chip investment

Source: DIGITIMES Research, July 2023

During this period, TSMC and Samsung competed for dominance in the wafer foundry sector, stemming from the growing popularity of smartphones. The winner was determined by securing orders for application processors from tech giants like Apple, Qualcomm, and MediaTek. TSMC's outperformance showcased Taiwan's aggressive investments in semiconductor equipment.

From 2008 to 2012, Taiwan accounted for 23.3% of global equipment purchases, while countries outside East Asia, including Taiwan, South Korea, Japan, and China, contributed 35%. However, in the period from 2013 to 2017, Taiwan's contribution dropped to 26.2%, and non-East Asian countries only accounted for 26.4%. In the 2018-2022 stage, Taiwan's share was 23.7%, and non-East Asian countries contributed a mere 18.9%. This led to issues of automotive parts shortages between 2021 and 2022, with blame being directed towards Taiwan and South Korean manufacturers. However, blame-shifting wouldn't solve the underlying problem.

Similar to the 19th-century gold rush, where those selling shovels thrived, early starters among equipment manufacturers in Europe, the US and Japan took the lead. The investments made by manufacturing plants in East Asia may ultimately benefit the original equipment manufacturers in western countries. In the modern world, those who put in efforts will gain a competitive advantage.

Finally, China's purchases of semiconductor equipment increased significantly after 2018. Was this a result of the "Big Fund" policy stimulating private investments? Among the equipment imported by China, how much was invested by Samsung, SK Hynix, TSMC, UMC, and Micron in China? Behind "Made in China 2025," there is a risk of excessive money wooing limited talent. China needs to guide the proper flow of resources and convince domestic and foreign elites to continue their efforts, especially in the face of Sino-US tensions.

For equipment manufacturers, creating new demand within a production diversification system will be a crucial challenge for the western equipment manufacturers. Can the successful experiences of South Korean or Taiwanese semiconductor factories be replicated in emerging markets? Perhaps inviting experts from the two Asian Tigers to share their experiences in industrial development in emerging countries would ignite more interest in developing the semiconductor industry there. Collaboration with South Korean and Taiwanese manufacturers might be the quickest path for these countries to develop their semiconductor industry.