Following a November 15 decision from Germany's Federal Constitutional Court against the transferring of EUR60 billion - granted during the Covid-19 pandemic but unspent in fiscal 2021 - into its Climate and Transformation Fund (Klima- und Transformationsfonds, KTF), the three-way ruling coalition led by German Chancellor Scholz is left to confront a budget shortfall that potentially undermines Germany's long-term chip investment, along with the problem posed by so-called special funds (Sondervermögen) that have long functioned as a shadow budgetary source unconstrained by the country's constitutionally enshrined debt brake introduced in 2019.

The KTF, notably, is the source of subsidies intended for Intel and TSMC's fab projects in Germany. In response to the ruling, as reported by German media, Germany's Federal Minister for Economic Affairs, Robert Habeck, indicated that the verdict would particularly impact the German industry, while Steffi Lemke, Federal Minister of Environment, told the German parliament, the Bundestag, that "we must not close our eyes to the important financing projects planned in the KTF."

German semiconductor industry optimistic for now

"It's an internal challenge, as a project portfolio of approximately EUR200 billion is now lacking EUR60 billion. As Intel and TSMC subsidies are covered by the EUR200 billion, a solution needs to be found quickly," said Frank Bösenberg, Managing Director of the industrial network Silicon Saxony that represents the region where TSMC plans its first European fab, to DIGITIMES Asia.

Nevertheless, the managing director remains optimistic. "The court decision certainly creates some uncertainties, which is always not optimal, but we trust in the government to find a solution for this challenge, in the best case before Christmas, to prove the so-called Deutschland Tempo. "Deutschland Tempo" is a term created by the new government to underline its quick decision-making process. A source familiar with Intel's operation in Germany also shares the optimism, telling DIGITIMES Asia that even though there's uncertainty, "I have a strong faith that the government will stick to the agreements, and I trust they will find a way to budget it differently." "Right now everybody is just assessing the consequences and answers aren't there yet," said the source.

At an event in the eastern German city of Leipzig, Chancellor Olaf Scholz also used the opportunity to emphasize that he "absolutely wants Intel in Magdeburg."

As indicated in a report by Germany's central bank, Deutsche Bundesbank, off-budget entities have taken on a much greater significance in recent years as the central government shifts tasks over to them on a large scale. According to the Bundesbank, "the off-budget entities had scope for deficits around EUR400 billion" for 2023 and coming years. For 2023 alone, the Bundesbank estimates that the deficit will account for 10% of Germany's GDP. Three special funds are mainly responsible: the KTF, the Economic Stabilization Fund (Wirtschaftsstabilisierungsfonds, WSF), and the Armed Forces Fund ( Sondervermögen Bundeswehr).

Data from Germany's Federal Court of Audit indicate that as of 2022, there are 29 special funds at the federal level. While some of them are dated back to the 1950s, some were created in recent year: the Economic Stabilization Fund for Energy Crisis (WSF-Energiekrise) and the Armed Forces Fund were both created in 2022, a fund to deal with flood crisis was created in 2021 (Aufbauhilfe 2021), while another Economic Stabilization Fund for Covid-19 (WSF- Corona) was created in 2020. The KTF was originally created in 2011, but topped up with EUR212 billion in August 2023 to finance various endeavors. "In an overall view, it is more accurate to speak of 'special debts' rather than 'special funds'," stated the Court of Audit in a recent report, "the actual net borrowing is significantly higher when taking special funds into account than the net borrowing indicated in the federal budget."

Data from the Federal Court of Audit shows that while the federal government's reported net borrowing was EUR115.4 billion in 2022 and estimated at EUR45.6 billion in 2023, if counting in the special funds, the figures will in fact be EUR195.5 billion and EUR192.8 billion, respectively.

For 2024, a total of EUR57.6 billion was planned to be allocated from the KTF, including EUR4 billion for semiconductor subsidies, EUR1.6 billion for electromobility promotion, EUR2.6 billion for electricity price compensation, and EUR12.6 billion for the Renewables Energy Act, as reported by the German news site capital.de.

Tighter budget in the future for Germany to meet its security needs

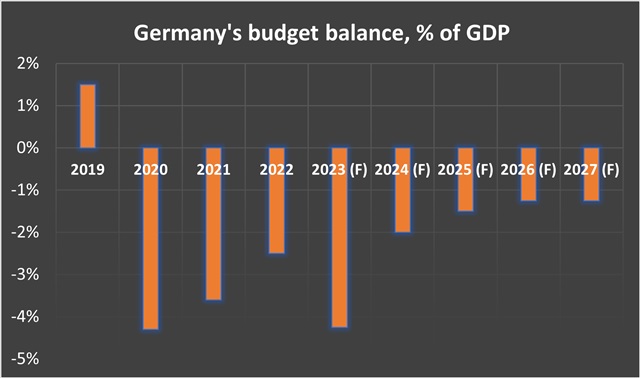

Germany's constitution limits the federal government's annual budget deficit to 0.35% of GDP, but the brake was suspended between 2020 and 2022 to deal with the pandemic. Christian Lindner, Germany's Minister of Finance from the liberal Free Democratic Party (FDP), aims to rein in the country's public finances and comply with the debt brake as he drafts the budget for 2024-27, warning that Germany's fiscal burden will increase in 2028 and beyond as debts from the pandemic era become due.

According to the finance ministry's forecast, the German federal government will face an annual budget gap of EUR5 billion in 2025-27. For 2024, the draft budget includes EUR16.6 billion in new debt, EUR30 billion less than 2023.

The constitutional court ruling came a day before the Bundestag was supposed to vote on the government's budget, and the vote has been delayed for a week following the constitutional court's ruling against "the de facto unlimited use of emergency borrowing authorizations in subsequent fiscal years without counting them towards the 'debt brake' rule for those years, and instead counting them as 'debt' for the 2021 fiscal year."

Notably, the ruling came as a result of a challenge filed by Germany's opposition party Christian Democratic Union (CDU). As reported by the German news channel ZDF, CDU leader Friedrich Merz is consulting legal experts if the the latest ruling against the KTF can also be applied to the WSF, before deciding if the opposition party will also take legal action against the WSF that finances governmental efforts to curb energy prices in Germany.

"We need to modernize economic policy structures in Germany and remove bereaucratic obstacles," said Roderich Kiesewetter, a CDU member of the Bundestag, in a conversation with DIGITIMES. "Furthermore, we need a rethink in energy policy: afterall, the high costs in Germany are also due to ideologically driven wrong decisions, and offsetting these solely with subsidies and money will not eliminate the cause."

Speaking of the debt brake-exempted EUR100 billion special fund created in early 2022 for Germany's armed forces, the Bundeswehr, to fulfill the country's commitment to boost its defense spending to 2% of GDP as required by NATO, Kiesewetter noted that it should be invested exclusively for the armed forces, though in the meantime, "almost EUR20 billion have been lost due to inflation and interest charges, while the remainder is not enough to make the Bundeswehr operational and to keep our NATO commitments." "In this respect, other measures and programs would have to be found to make the economy more resilient," observed the Bundestag member - a point that German policymakers will find it inevitable to reflect on as the integration of defense and semiconductor policies have become a trend.

Source: German Federal Ministry of Finance, assembled by DIGITIMES