I tried to work out some scenarios where TSMC could be defeated, the first being throwing in it into a state of panic. The semiconductor fabrication industry is highly connected with the surrounding infrastructure. A foundry service provider needs first-rate engineers and production environment. When I visited TSMC founder Morris Chang 13 or 14 years ago, he told me there was no land north of Hsinchu to build a 12-inch wafer fab. Aside from locations in central and southern Taiwan and properties owned by state-operated companies, the Taiwan government finally managed to find a piece of land near Baoshan in Hsinchu for TSMC to establish a next-generation production base. The goal was to enable TSMC to still tap the mature talent and stable water and electricity supply in Hsinchu. It is known that TSMC is given supply priority when there is water or power shortage in Hsinchu.

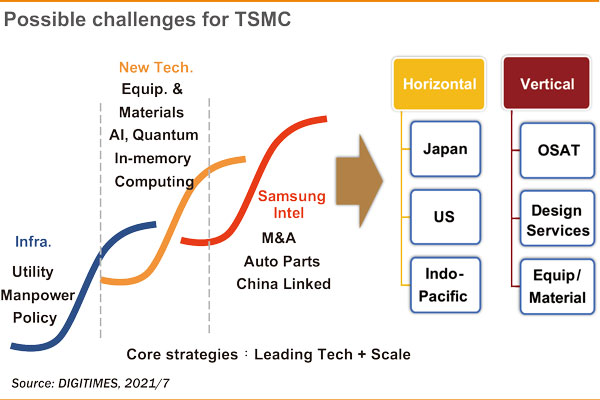

Now TSMC's concern is not getting surpassed in process technology or losing key customers but being overtaken by someone figuring out how to combine quantum technology and IC design. In-memory computing becoming a reality might be another scenario where TSMC could lose its competitive edge. However, according to Yu-Chung Lin, a DIGITIMES consultant devoted to the study of quantum technology application trends for years, large-scale commercialization of quantum technology is unlikely to happen before 2025. In-memory computing comes with high costs. If Samsung with leading-edge memory technologies really makes a breakthrough, TSMC will have to brace for challenges.

Competitors could team up to defeat TSMC. When it is up against an alliance of competitors with strengths that complement each other, TSMC may not be able to cover the entire court. For example, if TSMC received orders from Sony, Samsung could have UMC produce its CMOS image sensors (CIS). By allocating the majority of resources for the fight against TSMC, Samsung and partners could each get what they want and reach out to bigger goals. Furthermore, competitors could plan ahead for IoV and autonomous driving opportunities. For example, Samsung, sitting on a cash pile of US$100 billion, could acquire automotive semiconductor leaders including NXP and Infineon, betting its bottom dollar that their next-generation designs would still stay ahead. Having said that, I have to point out that the top-3 automotive semiconductor leaders each register a market cap around US$50 billion. There is little chance that Samsung will be able to acquire Japan-based Renesas amid the tense Japan-Korea relations. The US and Europe will not readily approve a foreign takeover of their main supply chain players. As such, we can expect none of these will happen. In other words, Samsung stands little chance of defeating TSMC in the next 10 years or so.

A magazine in Taiwan recently quoted Dae-je Chin, former Samsung president and Korea's former minister of information and communication, as claiming Samsung may grab half of TSMC's market share. I happen to know Dae-je Chin quite well. He left the semiconductor industry nearly 20 years ago, and his remarks about the industry may not be that accurate.

(Editor's note: This is the sixth part of a series of analysis by DIGITIMES Asia president Colley Hwang about TSMC's competitiveness and the foundry sector.)