Chilisin Electronics has firmly established itself in the Greater China region and it is now marching towards becoming a world-class inductor maker.

With IT technologies improving and demand from the retail channel rising, especially after the appearance of smart devices, products such as smartphones and tablet PCs are all experiencing strong growth in 2011 and providing their upstream component suppliers stronger business opportunities. The trend of the new smart devices that stresses lighter, thinner industrial design, higher system performance, longer battery life, lower power consumption has already affected the direction of technology development of related components. The ability to catch up with the trend and satisfy clients' demand has already become an important factor that determines whether a company can have a prominent share of the market.

Taiwan-based power inductor maker Chilisin in June 2010 significantly expanded its production capacity and also actively developed partnerships with channel retailers in Greater China in order to gain market share. With advantages coming from an integration of external and internal resources, the company was able to achieve US$100 million in revenues for 2010. The following is a summary of an interview with Chilisin's management team about its plan and view of the market in the future after the company achieved its revenue goal last year.

Following the trend and strengthening product advantages

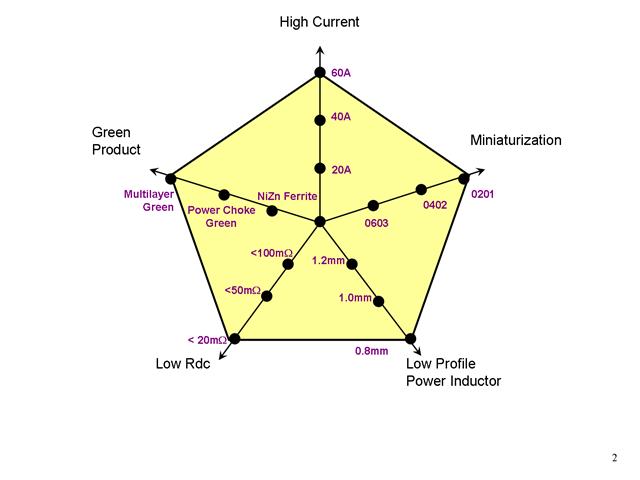

Chilisin pointed out that the company's inductor technologies have always been developed in line with the trend of end products and the company follows five major directions: high current, miniaturization, low profile power inductor, low RDC and green product. The company has been shipping its power inductors to makers of such end products as consumer electronics, notebooks, network communication equipment and car electronics and is now gradually expanding to other popular products such as smartphones, tablet PCs, network communication modules, LCD TVs and USB 3.0 devices. From these end products there are strong demand for components such as multiplayer beads and inductors, LVS and ultra-thin power chokes.

Chilisin has achieved considerable results in Greater China and has a monthly capacity of two billion multilayer inductors, the largest among all makers in the Greater China region. The company has also recently developed a full series of multilayer power inductors and with support of its strong capacity, the company is very cost-competitive.

As for the wire wound chip inductor business, the company currently has a monthly capacity of 120 million units, is capable of shrinking the products to the size of 0302, and is in a leading position in the Greater China region. The company's common mode choke product line, following the trend of USB 3.0 applications, is moving gradually from common mode 21 (USB2.0) to common mode 11 (USB3.0) with monthly capacity already reaching 30 million units. As for the LVS business, due to its low cost and small size, the product is mainly used for replacing the traditional power inductor, and is being adopted in products such as handsets and other portable devices. The company already has a complete product lineup for the business with a monthly capacity of about 50 million units.

Advantage from internal integration to help boost market share in Greater China

Chilisin also pointed out that the company's strong performance is partly contributed by its effective internal integration and management. Chilisin's Taiwan office is mainly in charge of R&D on product technology, as well as R&D and manufacturing of materials, such as powder and iron core. Since powder is one of the key materials for power inductors, the company's in-house production of the material gives the company advantages in terms of cost, quality and supply stability compared to its competitors who source their materials from outside suppliers. Chilisin's plant in Dongguan, China is gradually heading towards full implementation of production lines with automation equipment, while its plant in Henan, China will handle most of the labor-intensive products. The combination of the two types of production lines has given the company an advantage in terms of labor cost. In addition to the Greater China region, Chilisin has also been aggressively cutting into the US and Europe markets, aiming to become a worldwide first-tier maker with a comprehensive lineup of inductors.

In addition to the integration of upstream materials and downstream R&D technologies to achieve better quality and lower cost, the company offers total solutions covering complete design-in services, R&D and FAE support. These are important assets for the company to gain share in the US the Europe markets.

Impact of Japan's March 11 earthquake

The impact of Japan's earthquake can be assessed separately from two aspects. For raw materials, the company has diversified sources of key metal material supplies, and runs in-house production of chief powder. Therefore, the company will not see material shortages. As for orders, some downstream players have already started shifting their orders as they have learnt the risk of putting all eggs into one basket. Such a change has also given more clients an opportunity to realize Chilisin product's quality, strong technology and services.

Future expectations and development strategy

Judging from the interview, it is clear that Chilisin is not only a leader among Greater China makers, but is also taking big strides towards becoming a world-class player. Chilisin saw its 2010 revenues grow 54% from 2009. In 2011, the company expects to continue its leadership in Greater China, while expanding into the US and Europe markets. Chilisin's business will be guided by its moto, "Follow the Trend; Go with the Winner," in its aspiration to become a first-tier power inductor maker worldwide.

Power inductor development trend

Photo: Company