I have many years of experience in industry research, information integration, and making charts on my own. But as the research tools continue to evolve, everyone has his or her talents or skills in one way or another. I am delighted to explore and share what I have learned and experienced during my 36 years' experience in the industry.

The earliest industry research work was to glean and interpret sources from magazines and newspapers. Acer co-founder, and the chairman of PIDA (Photonics Industry & Technology Development Association) Kenneth Tai said sources of overseas publications gave us nothing but general outlines of market trends. During this stage, he said we're like a blind swordsman aiming at nowhere. Proficiency in foreign languages became a prerequisite for an entrepreneur or analyst. However, these are all research methods belonging to "Stone Age" of industry analysis.

Without understanding industry multitasking, huge volumes of data, criss-cross matrix of industrial structure and market segments, analysts will have trouble analyzing the industry. People in charge of compiling information or even listeners of report may get disoriented. At this point, we cannot overemphasize the importance of methodology and understanding of the macrostructure within this data-driven age. Industry analysts need to keep pace with the times. In addition to making good use of data tools, they are obliged to "define" the research framework based on their own or core customers' needs, coinciding with their fields of mastery to avoid going on a wild goose chase.

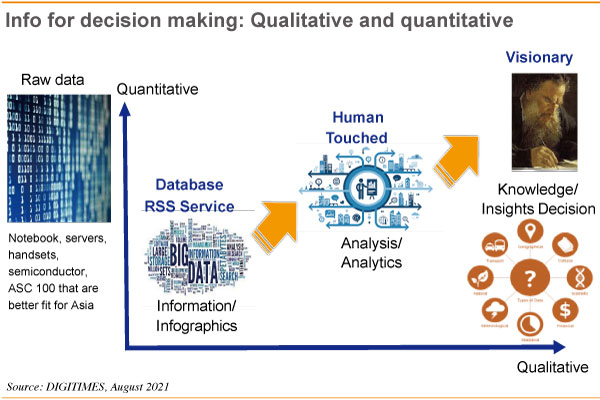

In general, the information pipeline of the industry starts with raw data which runs along to merge with the primary information, with slightly processed and value added infographics, followed by data "analysis" and "analytics" of trend predictability, and taken to the final level of "insights decision" which delivers intrinsic service value requested by supervisors or customized for core customers.

In view of DIGITIMES' business model and entrepreneurial experience, we may start with survey of raw data, which is related to its management strategy and business models. For instance, IDC has been studying market size and brand market share in major countries since the 1980s. After 40 years of research, IDC's accumulated database and research capabilities are indeed one of the indispensable tools to help capture the global PC market demand.

DIGITIMES does not have a global investigation mechanism; instead we concentrate our research in the most upstream of the IT supply chain. Due to Taiwan's small size and high concentration of publicly listed companies who deliver monthly financial reports and other basic information, with a grip on the structure of the supply chain, you can naturally conduct investigation of the supply chain in depth. Because of different positioning, we have many readers from specialized research institutions such as IDC, Gartner, McKinsey, Nomura, and IHS.

For instance, we have selected some of Taiwan's leading-edge industry sectors - notebook, server and handset - and for each of them we conduct in-depth and long-term investigation in 25 key component categories, such as semiconductor, panel and PCB. This is a long list of about 100 items of key components, representing market supply-demand leading indicators and serving important reference for enterprises to adjust their procurement decision and pace of shipment.

But these basic data must come with updated news and better writing and graphics skills, or else they are just figures. The data can be developed as infographics service or data bank service by merging with updated news and research reports. For DIGITIMES, the crucial point of this service is positioning of information: should the focus be on the supply chain or market demand, technology news or industry news? The editor-in-chief or director of research center selects the types of information based on different business positioning to build up an alternative database over the years - rather than jump on the bandwagon. Basically Google and Facebook's powerful networks catch all hot news. Instead of telling stories or competing with the world-class Internet tech giants, we satisfy the needs of core customers.

(Editor's note: This is part of a series by DIGITIMES Asia president Colley Hwang about industry research work.)