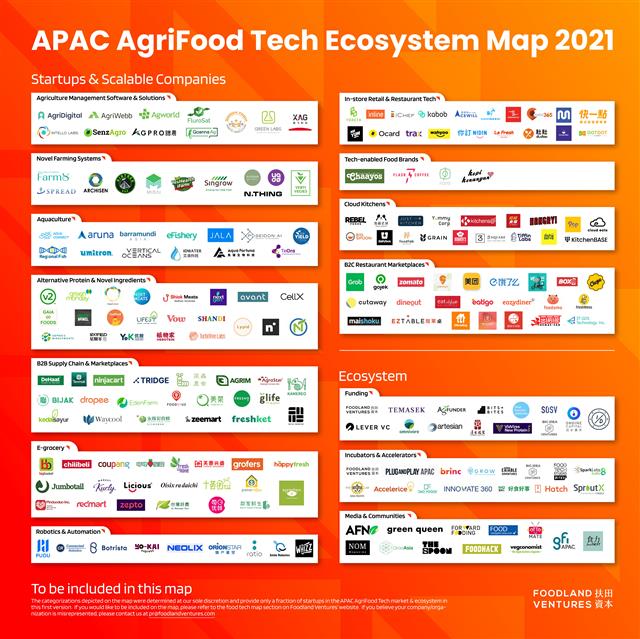

Cloud kitchens have seen popularity grow fast in the Asia-Pacific amid the pandemic. Since 2020, the Asia Pacific region has gained the highest market share in the cloud kitchen sector, according to Reportlinker. Agri-food tech firms from China, India, and Singapore have accumulated more than US$7 billion in investment in the first half of 2021.

A cloud kitchen is a co-working space for cooks where they cook for takeouts and delivery only with no dining area. The pandemic has knocked a lot of dine-in restaurants down and food delivery services are taking over. Delivering from a cloud kitchen speeds up the process. Restaurants can lease their recipes and by working with cloud kitchens reach farther neighborhoods.

India-based cloud kitchen service provider Rebel Foods raised US$175 million in October with company valuation reaching US$1.4 billion, according to Foodland Ventures. Just Kitchen went public in Canada in April. There are also Yummy and Hangry from Indonesia, CloudEats from the Philippines, PopMeals from Malaysia, and 3 Square from Taiwan.

Digitalization in the food supply chain

During full-scale lockdowns, food suppliers had to find other outlets to sell fresh produce before they went bad. Online grocery distributing and delivery platforms were driven by such circumstances.

According to Fodland Ventures, India-based B2B AgriTech DeHaat raised US$115 million this year. Food supply chain Ninjacart reached US$500 million in company valuation this year. Indonesian TaniHub raised US$65.5 million. Vietnam-based Kamereo and Taiwan-based TsaiTung Agriculture are growing fast as well. In Singapore and South Korea, vertical farming, indoor farming are emerging. Farm8 plans to go public next year; N.THING has raised US$2.6 million. Singapore-based Sustenir Agriculture raised US$15.4 million.

Trending alternative protein

Singapore is the first country in the world to approve commercial sales of cultured meat. Singapore-based Next Gen Foods has raised US$32 million and Shiok Meats US$20.4 million. Other alternative protein manufacturers in the APAC region include v2food from Australia, Green Monday from Hong Kong, and Starfield from China.

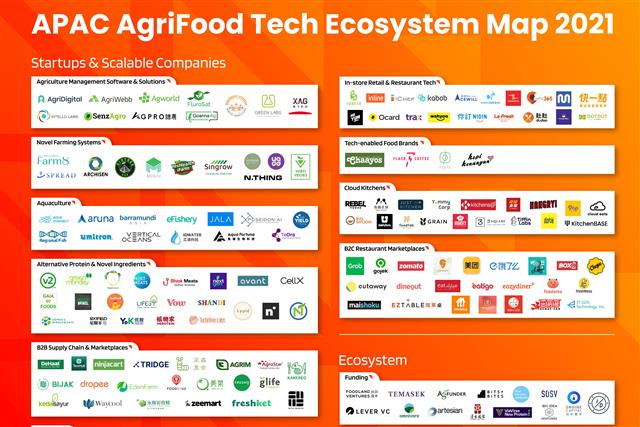

Credit: Foodland Ventures