Could you even still remember the time when you first heard about "climate change"? Nowadays, climate change is no longer just talk or a myth, but unavoidable reality. Did you know that in Taiwan, if we do not actively implement carbon reduction the temperature will continue to rise, and by the end of the 21st century the number of summer days will increase from 80 to 210 days? At this rate, by 2060, winter will disappear from our lives.

The latest "Global Risks Report 2021" released by the World Economic Forum (WEF) announced the global risks ranking. "Extreme Weather" has ranked first as the most likely risk for the fifth consecutive year, and "Climate Change" has come in second for the third consecutive year.

Climate change has a huge ongoing impact on business operations. Extreme weather events such as droughts, floods, and forest fires have severely affected human lives, damaged infrastructures and corporate supply chains, causing huge economic losses. Climate change also entails transformational risks, including amendments to laws and policies, changes in market supply and demand structure, impacting and imposing variables on business operations. In the face of climate change, to demonstrate and strengthen enterprises' sustainable competitiveness, it is crucial to quantify the impact climate change brings, expose potential financial impacts, and incorporate climate risks into the risk management decision-making process.

As the impact of climate change intensifies, companies should also feel increasing pressure from investors, capital markets, and stakeholders, requiring companies to provide management responses to climate-change-related risks and expose potential impacts. BlackRock, the world's largest asset management company and the largest foreign investment institution in Taiwan's capital market, stated that "climate change has become a defining factor in companies' long-term prospects." Investors' attention to climate change is rapidly increasing, and most have already categorized climate risk as an investment risk. However, when companies insufficiently disclose climate-related financial information, investors will find it difficult to evaluate climate-related issues while making investment decisions.

In 2015, Mark Carney, the former chairman of the Financial Stability Board (FSB) and president of the Bank of England, along with Michael Bloomberg, the founder of Bloomberg, the world's largest financial information provider, announced the establishment of the Task Force on Climate-related Financial Disclosure (TCFD). They provide companies with a complete climate-related financial information disclosure framework.

Both Taiwanese authorities and international investment institutions require companies to introduce their TCFD structure and content to gradually improve the identification of climate-related risks and opportunities and to formulate specific countermeasures. In August 2020, the Financial Supervisory Commission (FSC) stated in the "Corporate Governance 3.0 – Sustainable Development Roadmap" that companies should refer to the TCFD international standards to strengthen the disclosure of information in their sustainability reports of 2023. In January 2020, BlackRock stated that they have asked companies to demonstrate they were adequately managing climate and other sustainability-related risks by reporting in line with TCFD framework and metrics provided in the SASB standards. Besides, BlackRock has used its voting power to support climate-related issues, "We took voting action against those companies where we found corporate leadership unresponsive to investors' concerns about climate risk or assessed their disclosures to be insufficient given the importance to investors of detailed information on climate risk and the transition to a low-carbon economy."

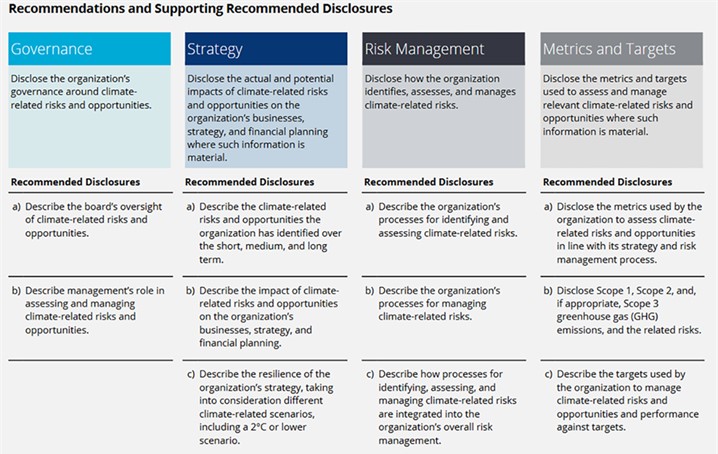

TCFD's disclosure structure is established by the task force on climate-related financial disclosure based on the four core elements of the organization's operations, namely governance, strategy, risk management, and metrics and targets. The table below shows the task force's recommended disclosures.

Source: TCFD

At present, more than 1,700 organizations worldwide follow the TCFD recommendations while disclosing information. In Taiwan, there are currently 67 companies and organizations that are signatories that support TCFD, of which the majority are from the financial and technology industries respectively. Companies should confront the impacts of climate change as early as possible, through understanding and implementing the TCFD framework, managing risks and utilizing opportunities, and formulating response-strategies to reduce the operational impact that climate change may cause, strengthening organizational resilience, and enhancing corporate competitiveness; heading towards a path of low-carbon and sustainable development.

Editor Note: DIGITIMES has invited QIC as a contributing partner to share their insights in a 5-part series: 1) Should companies invest in ESG? 2)Third-party ESG reporting 3)ESG metrics matter 4) Resource guide for staying up to date on global unification of ESG reporting standards and 5) Getting ready for climate-related financial disclosures. The article is the fifth part of the QIC ESG Series, which was originally published on QIC website.

Photo: QIC