Remember TDK, the familiar logo appearing on those audio cassette tapes? While one might be quick to associate the Japanese electronics manufacturer with a bygone era, TDK remains a major player in electronics. With a current market capitalization of US$12 billion, TDK has been the main manufacturer of passive components. Almost a century since its foundation in 1935, TDK is still looking ahead. TDK Ventures, its newly created venture capital arm, marks TDK's latest effort to gain a foothold in the future.

Founded in 2019 and headed by Nicolas Sauvage, an industry veteran who formerly served as the worldwide sales director of NXP Software and later joined the MEMS sensor provider InvenSense, TDK Ventures arrived in time for a global digital revolution accelerated by the COVID-19 pandemic.

In fact, even prior to the outbreak, TDK Ventures had already gotten a taste of how digitalization could accelerate venture capital investment. "TDK Ventures' first two investments were made remotely," remarked Sauvage in a pre-event interview for Asia Venturing: The Great Convergence - Why is Industrial Tech the Next Big Thing, co-hosted by Anchor Taiwan and DIGITIMES, "We did all the engagements, reviews, and due diligence remotely." As the pandemic came, the pace of investments also picked up. According to Sauvage, TDK Ventures invested in four companies in a span of three months – a sharp contrast to spending the previous nine months on four other investments.

Seizing the latest wave of corporate venture capital investment

TDK Ventures' investments during the pandemic not only demonstrated its decisiveness but also gave it a firm head start amidst the latest wave of corporate venture capital (CVC) investment.

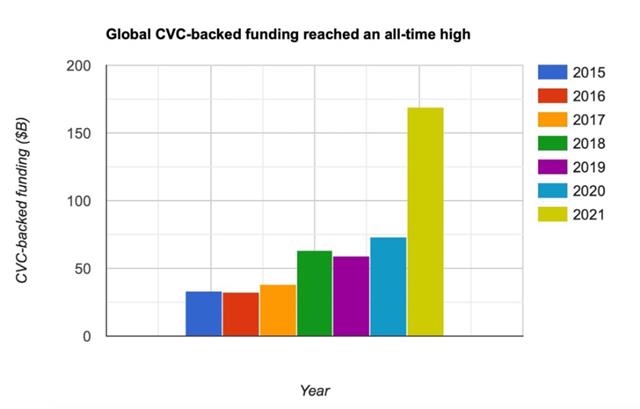

According to recent research conducted by the industry group Global Venturing, the number of CVCs grew from 380 to more than 1,850 between 2011 and 2019. CB Insights also reported a similar trend. In 2021 alone, 221 new CVCs were created, leading to a rebound of CVC growth after a 6-year low. In addition, global CVC-backed funding hit an all-time high in 2021, reaching US$169.3 billion. The number marks a 142% jump from 2020 when global CVC-backed funding amounted to US$70.1 billion.

"TDK Ventures got the chance to invest when there were fewer CVCs and VCs competing with us," Sauvage pointed out.

When it comes to Industry 4.0 investment, a sector with a high entry barrier due to its capital-intensive nature as well as the required in-depth knowledge of both hardware and software, the advantages of CVCs especially stand out with their vast resources at disposal. In fact, with its long expertise in material science and industrial technology, TDK has become a major Industry 4.0 investor and sees a future where hardware components are equally globalized like the software industry.

TDK Goodness, a central tenet of TDK Ventures that prioritizes entrepreneurs instead of investors, perhaps best illustrates why TDK Ventures is such a unique yet powerful investor. "We add value to entrepreneurs by accelerating their projects and reducing risks, '' Sauvage explained of TDK Goodness. Therefore, even though some startups don't fit TDK's financial requirements, TDK Ventures still assists them to find the right investors or partners. According to Sauvage, these startups can still be good suppliers and customers of TDK.

Source: CB Insights; Compiled by Anchor Taiwan

Looking for the "King of the Hill"

In 2017, TDK completed the acquisition of InvenSense, bringing Sauvage into the arms of the Japanese conglomerate. Then in 2018, while at the Stanford executive program, Sauvage came across the idea of corporate venture capital. The six-week management training course taught Sauvage the strategic value of CVCs: instead of spending hundreds of millions of dollars to explore unfamiliar industrial sectors with M&A, corporates can simply invest in startups in those sectors.

Sauvage likened the process to a "race to the mountain top." In this sense, CVCs are like helicopters that explore various mountains and report the situations on the ground back to their motherships. "A good CVC delivers insights to corporations." In fact, before TDK Ventures' conception, TDK itself had already been experimenting with some forms of venture capital, annually investing $20-$30 million into startups. Nevertheless, it lacked a dedicated structure designated to coordinate such activities.

"Back then, nobody in TDK was looking for new technologies in new markets," observed Sauvage. "Instead, people were either looking at new technologies in existing markets or new markets in existing technologies." Against this backdrop, Sauvage envisioned a CVC dedicated to new technologies in new markets, identifying potential "Kings of the Hills" who would be the No.1 market leaders in five years.

The idea, pitched to TDK leadership in 2018, quickly got accepted and implemented, taking less than a year. Now, armed with a total of US$200 million, TDK Ventures has already reviewed more than 3,000 startups. 24 of which have received investments from TDK Ventures.

Almost a century since its foundation in 1935, TDK is still looking ahead; Credit: Unsplash

More global or more local?

As an investor in hard-tech companies, Sauvage pointed out that many solutions required a deep level of hardware-software integration, giving Asia opportunities as a hub of electronics manufacturing. Therefore, more Asian VCs and CVCs will be active on a global scale.

TDK Ventures, itself based in Silicon Valley, already plays an important role in bridging cross-border collaboration: in early 2022, TDK Ventures led the investment into the U.S. water electrolysis startup Verdagy, bringing in the Singaporean state investor Temasek in the process. In another recent example, TDK Ventures brought Toyota Ventures along to invest in the U.S. battery startup AM Batteries.

However, Sauvage also noted how the end of the just-in-time supply chain, compounded by geopolitics, is driving a force of localization alongside globalization. "The pandemic created a smaller world where people can collaborate with each other easily, but antifragility requirements prompt us to think more local, and the impacts more local," noted Sauvage. Consequently, even as TDK Ventures seeks out global kings of the hills, "local and regional kings of the hills" are also growing in importance, especially in the context of supply chain resilience.

As the forces of globalization and de-globalization unfold side by side, Asia finds itself at an unprecedented juncture. What is the way forward? Join us in the next session of Asia Venturing: The Great Convergence - Why Industrial Tech is the Next Big Thing (7 PM APR 25 SF | 10 AM APR 26 Taipei). Together with Nicolas Sauvage, Ken Forster, executive director of Momenta, and Elisa Chiu, CEO of Anchor Taiwan, we will walk you through the landscape of Industry 4.0 investment and where Asia stands.

About Asia Venturing:

Asia Venturing is a series of monthly roundtables with roadmaps to the future focusing on the hype v.s. the reality of Asia's supply chain-boosted innovation ecosystem, jointly powered by DIGITIMES and Anchor Taiwan. We bring together leading industry luminaries, corporate strategists, experienced investors, and entrepreneurs to expand your network and redefine the possibilities of cross-border opportunities. The replay of the latest session can be seen on DIGITIMES or Anchor Taiwan)