MediaTek launched its first mmWave application processor (AP), the Dimensity 1050, towards the end of second-quarter 2022, nearly two years later than Qualcomm and Samsung Electronics. The late introduction may not be the result of weaker technology; market demand and customer structure are also important factors.

MediaTek's main customers are Chinese cell phone manufacturers, and it the demand it sees from the market is different from what Qualcomm and Samsung see. mmWave applications are mostly used in the US, and the current market share of the US 5G smartphone market is led by Apple (47%) and Samsung (28%), boht of which have relatively higher demand for mmWave applications.

The Chinese handset vendor who is most interested in mmWave handsets is Lenovo, which has acquired the Motorola brand. Lenovo also has a good market share in Latin America and North America. LG has just withdrawn from the US market, and Lenovo is in a good position to replace it.

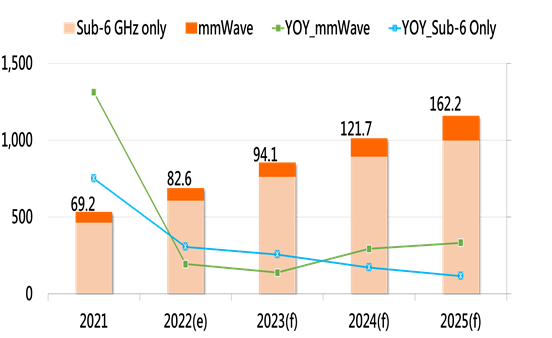

Secondly, it is estimated that the global mmWave handset market will be about 82.6 million units in 2022, which is 12% of the global 5G handset market, and will grow to 94 million units in 2023, and in 2025, the share may only be 14%, showing little change in proportion.

In the smartphone AP market, Samsung, which is the world's largest handset vendor, may still offer big business opportunities for MediaTek. DIGITIMES Research estimates that 51% of the APs used by Samsung come from Qualcomm and 33% from in-house-developed productl liness, and MediaTek now has a 16% contribution to Samsung's phone lineup. But does MediaTek still have a chance to expand its market share?

In the IT industry, anything is possible. It's possible that two rivals team up against a bigger competitor, such as Samsung giving its foundry orders to UMC. With MediaTek, Samsung will be able to negotiate better terms for AP supplies with Qualcomm, and its own design team can focus on more strategic areas.

MediaTek's Dimensity 1050 is based on TSMC's 6nm process, and MediaTek's strategy should still be embracing the "premium economy class" concept. Unlike Apple and Samsung, which are targeting flagship models, MediaTek hopes that its customers can take the lead with mid-range models, which is MediaTek's consistent strategy for different segments, from white-box devices to mainstream ones. In the longer term, MediaTek's current product launch may just be a warm-up for its deployments in industrial control, medical, and satellite communications.

mmWave smartphone shipments and share of 5G handset market, 2021-2025 (m units)

Source: DIGITIMES Research, May 2022