At this stage, it is clear that China wants the Pacific Ocean to be big enough to accommodate the two powers of China and the US, and to gain more time and space in order to bring its national power to its peak. Whether it is intruding into another country's air identification zone or entering the Miyako Strait, the purpose is to find a favorable argument and foothold in a confrontational environment. But the US obviously does not let an enemy lurking around and adopts a strategy of maximum pressure.

It is a consensus of the US government and society to compress China's space. While the US keeps emphasizing the order of the international community, linking up with Japan, India and Australia, and maybe even deploying heavy troops in East Asia. But unless Kim Jong-un turns beserk, the hot zone is actually in the Taiwan Strait.

In order to survive the confrontation between the US and China, Taiwan must have a certain understanding of the strategic patterns of both sides, but also needs to grab the best foothold according to its own conditions. Businesses, especially those with factories in China - like those in the US technology industry - mostly adopt a dovish stance, maintaining strategic patience in the hope that the next era of prosperity will come after a period of inaction.

US secretary of commerce Gina Raimondo has said that 70% of US high-end chips come from Taiwan, implying that without Taiwan, the US would be crippled in semiconductor chips for commercial operations, satellites, and defense applications. But would China be better off? If you check the customs data of Taiwan and South Korea, you can see that Taiwan and South Korea export 60% of their semiconductors directly to China. For this reason, the US is actively pursuing TSMC and Samsung Electronics to set up fabs in the US to do the most advanced process.

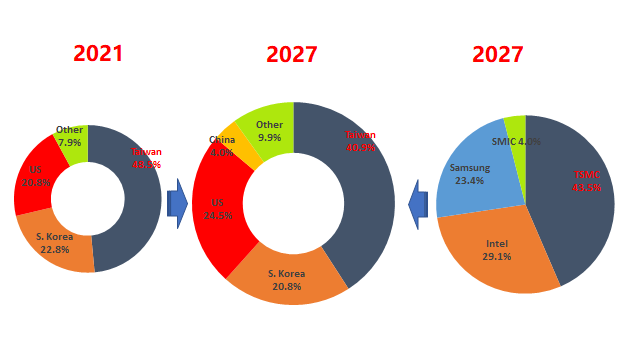

According to DIGITIMES Research, in 2021, 48.5% of the world's capacity for advanced processes below 10nm was in Taiwan, 22.8% in South Korea, and 20.8% in the US. Since TSMC, Intel and Samsung have been the only players competing in the sub-10nm segment, this ratios by country are also the ratios respectively for the three companies.

But with the US government reaffirming its strategy of having meaningful control of the supply chain, TSMC and Samsung are having a hard time maintaining their strategic ambiguity, and Samsung is taking advantage of Biden's visit to South Korea to announce its ambitious investment plans.

Samsung is expected to increase its share to 23.4% by 2027, Intel, with the support of the US government and society, will increase to 29.1%, and TSMC will decrease slightly to 43.5%. However, by production locations, Taiwan will drop to 40.9%, South Korea will decline to 20.8%, and the US will rise 24.5%. China, using DUV equipment, may also have a place in the sub-10nm segment in 2027, accounting for 4% of global production capacity.

Sub-10nm process capacity by country

Source: DIGITIMES Research, June 2022