The year 2023 stands as a pivotal moment in Extended Reality (XR). If historians were to select a period to study this chapter of spatial computing history, they would likely focus on a crucial ten-day span that has recently transpired:

From May 31 to June 2: Augmented World Expo (AWE) 2023

June 1: Meta's announcement of Quest 3, with a spotlight on mixed reality

June 5: Apple's introduction of Vision Pro

This is an opportune moment to review the strategies of Meta and Apple in the realm of XR.

Apple carefully directed its public announcement towards familiar use cases, particularly those involving Apple apps, operating in an Augmented Reality (AR) mode. They scarcely mentioned that Vision Pro also functions as a Virtual Reality (VR) headset akin to Meta's VR devices. Apple is resetting the tone for XR by making it more accessible. The message is lucid: consumers won't have to "relearn" how to use their Apple devices. The Vision Pro is merely another piece of hardware that integrates seamlessly into their ecosystem. It's as if Apple is saying, "you already know how to make video calls and watch Disney movies. Do it on Vision Pro – it's better, and you already know how to use it!" This maneuver is clever on Apple's part, not just for fostering market adoption, but also for encouraging developer adoption. Given that most consumers currently lack an XR headset, it will take some time for app developers to prioritize creating apps for XR. By making it effortless to port iPhone, iPad, or Mac apps to Vision Pro, Apple could increase the range of activities consumers can perform on the device before the truly immersive features across various apps fully mature.

Though both Apple and Meta are focusing on consumer-centric use cases, their go-to-market strategies differ. Meta was the first Fortune 500 company to prominently feature XR in its business. In contrast, Apple's Vision Pro announcement is their inaugural public disclosure of their XR ventures. The Vision Pro embodies Apple's more measured and conservative long-term vision. While Meta subsidizes hardware to solidify their market leader position, Apple dares to price their first XR headset in the $3,500 range, making it 3.5 to 10 times costlier than Meta's headsets. Apple prioritizes delivering the best possible user experience before considering price reductions for broader market adoption. This distinction mirrors the nature of Meta and Apple's core businesses – social platform versus hardware, respectively. The XR industry stands to benefit significantly from Apple leading the next wave.

This year at AWE, advancements in headsets from solution providers, enterprise players, and smaller consumer brands exhibited notable progress compared to the previous year. They offered more compact designs, higher resolution, and superior brightness solutions. Magic Leap, for instance, presented the Magic Leap 2, featuring lighting segmentation that allows users to control the degree of "dimming" in their environment, thereby influencing how much virtual objects stand out. Xreal (formerly Nreal) displayed headsets with updated software viewing modes: users can position the virtual screen off to the side to focus on real-world objects in their central field of view. Alternatively, users in transit can have the virtual screen maintain a fixed position to ensure a stable and centered viewing experience. These examples highlight further insights gleaned from real-world users. The industry is primed for continued UX improvements to further adoption.

Another sign of the maturing XR industry is the participation of consumer brands such as Loreal and Coca-cola at AWE this year. XR is transitioning from an experimental to a viable marketing option. Among the established eCommerce use cases, Loreal uses gaming to increase brand awareness, while Snap's investment in virtual try-ons is gaining traction. Whether it's trying on a North Face down jacket in different colors or experimenting with various makeup styles, it's now just a Snap lens away. The number of attendees not directly involved in the XR industry but seeking solutions has increased this year. For instance, a golf equipment company is exploring AR to enhance the golfer's experience. As real-world use cases inspire the industry, and the technology becomes more accessible, we see the XR industry reaching significant milestones. These milestones will become even more tangible when Vision Pro enters the market in 2024. For those in the XR industry, recognize that each of your contributions makes a significant difference. For those outside the industry, I encourage you to explore how XR relates to your business before your competitors' products provide the answers.

(Please note that the above represents the author's personal opinion and may not reflect the views of her employers.)

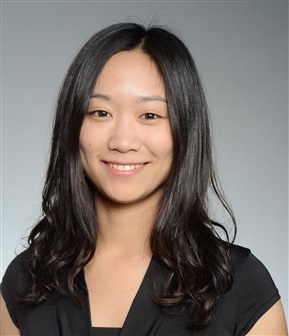

Author's bio

Kari Wu is a Senior Technical Product Manager at Unity Technologies, the leading platform for creating real-time interactive 3D content. Previously, she was an entrepreneur focused on augmented and virtual reality. Kari founded FilmIt, a startup enabling users without formal training to film professional-looking videos using augmented reality and automated editing solutions.

Born in Taiwan and raised across cultures, Kari brings a global vision to her work. Her experience consulting businesses in South Korea and Taiwan, and living in Boston, Los Angeles, and San Francisco, gives her a unique ability to see from multiple perspectives. From immigrant to entrepreneur to tech leader, Kari's lifelong curiosity has driven her journey of evolving identities and careers. Kari earned her MBA and MS in Media Ventures from Boston University.

Kari Wu