Semiconductor industry is extremely capital-intensive and technology-driven. Those players who hold dominant positions define the market. To illustrate this, I'll use the analogy of "World Baseball Classic."

The US stands as the top-seeded team among the world's elite eight, boasting cutting-edge technology, advanced equipment, and also playing the role of rule-maker in the game. Taiwan and South Korea, respectively leading in the wafer foundry and memory chip industries, emerge as strong contenders in the global semiconductor landscape. The EU and Japan, with their solid industrial foundations encompassing equipment and materials industries, hold considerable sway. Meanwhile, attention is drawn to China's plans to sustain its semiconductor industry and India's potential to leverage its abundant IC design talent, along with the future opportunities in the metaverse.

The last spot in the quarterfinals should be earned as a wild card by countries participating in the qualification round. Mexico and India, establishing themselves as electronics manufacturing bases in recent years, vie for this spot. Additionally, resource-rich countries like Australia and Canada, and efficiently managed Singapore, excel as potential competitors.

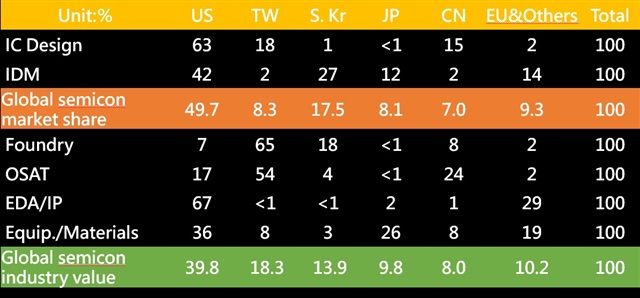

Global Semicon Industry Marketshare, 2022

Source: DIGITIMES Research, Feb 2023

Market research firms in the US reveal that the global semiconductor market scales at $575 billion, combining both the IC design and integrated device manufacturers (IDM) industries from a market perspective. The US IC design industry accounts for 63% of the global market, while IDM companies account for 42%, culminating in a combined total revenue share of 49.7%. In other words, nearly half of semiconductor products sold in the global market carry an American brand.

Beyond the US, Samsung and SK Hynix command a 17.5% global market share due to their dominance in the DRAM and NAND flash industries. Following closely are Taiwan, Japan, and China, excelling in the IC design sector.

From the supply side, manufacturing services like wafer foundry and packaging testing, along with EDA (Electronic Design Automation) tools, materials, and equipment, all play crucial roles in supporting the semiconductor industry's development. Considering the demand-side, IC design and IDM companies, US firms still maintain a significant contribution of 39.8% to the global market, followed by Taiwan with 18.3%, South Korea with 13.9%, and Japan and China with 9.8% and 8% respectively. These five countries are the primary contenders in the global semiconductor industry. Europe, though dispersed with companies like Infineon, STMicroelectronics, NXP, and equipment manufacturer ASML across different countries, holds the potential to become a vital force if integrated and supported by each other in the automotive semiconductor sector.

As the electronics industry's focus shifts from laptops and smartphones to the era of the Internet of things (IoT) and AI, the semiconductor industry's operational focus is evolving accordingly. "Cutting-edge chips" are no longer solely dominated by microprocessors and application processors but are diversifying into specialized AI chips. Moreover, top-tier wafer manufacturing now extends from the frontend to the backend of packaging and testing.

Additionally, power semiconductors like SiC and GaN, which were once challenging to produce in volume, are experiencing new advancements. While AI chips make progress, Samsung's memory chips are also emphasizing the functionality of HBM-PIM, and the business opportunities in the field of edge computing are no longer merely a distant dream.