In the global quest for renewable energy solutions, the offshore wind industry has emerged as a pivotal player.

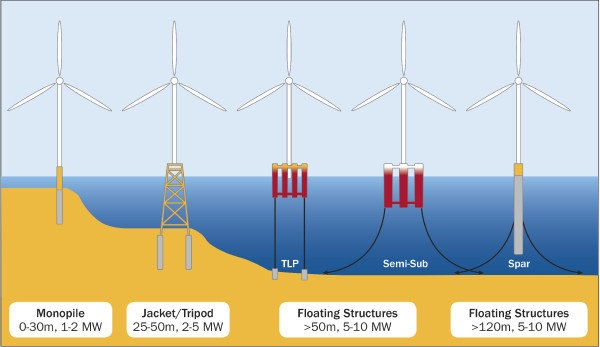

The vast untapped potential of offshore wind resources offers higher wind speeds and more consistent energy generation compared to onshore options. The utilization of floating offshore wind farms globally still trails behind bottom-fixed variants in actual grid-connected capacity. 80% of the world's offshore wind resource potential lies in waters deeper than 60m, but only 188 MW of net floating wind capacity is in operation worldwide, accounting for 0.3 % of total installed offshore wind capacity as of the end of 2022.

Europe leads the way in floating wind. As for regional distribution, the Global Wind Energy Council(GWEC) expects Europe to contribute 66% of total installations added in 2023– 2032, followed by APAC (32%) and North America (6%). By the end of 2032, a total of 26.2 GW of floating wind is likely to be installed worldwide.

However, GWEC still predicts floating offshore wind will not reach commercialization until 2030. Taking into account the higher cost of floating wind energy, current challenging economic and financial conditions, and expected supply chain bottlenecks in floating wind foundations and port facilities, GWEC has downgraded its global floating wind forecast to 10.9 GW by 2030.

Credit: ResearchGate

The prevalent forms of technology actively employed in the global development of floating offshore wind power include three main types: Semi-submersible, Spar-buoy, and Tension leg platform(TLP). These solutions have been crucial in overcoming the challenges posed by deeper waters, where traditional bottom-fixed turbines are not feasible. Environmental factors specific to each maritime region, localization efforts by different countries, and supply chain considerations all influence the choice of underwater foundation types by development teams.

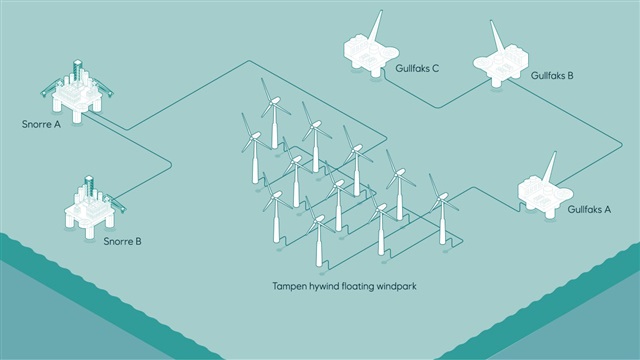

One of the flagship projects is the Hywind Tampen project, in the Norwegian North Sea, which boasts an impressive 95 MW capacity, making it the world's largest floating offshore wind farm.

According to GWEC, Norway commissioned 60 MW of floating wind capacity in 2022, bringing the region's total installations to 171 MW, equal to 91% of global installations, followed by Asia-Pacific (16.7 MW, or 9% of global market share).

Credit: Equinor

The offshore wind industry in Taiwan has also gained significant momentum, with the government setting a target of 30% renewable energy by 2030. The current offshore wind capacity stands at 2.3 GW, with 288 turbines in operation. However, the country's ambitious goals stretch even further, aiming for 13.1 GW by 2030 and a staggering 40-55 GW by 2050.

The Taiwanese offshore wind landscape poses unique challenges, with water depths ranging from 50 to 100 meters, predominantly in the central and southern regions. This depth range falls within the intermediate to deep waters, making it unsuitable for traditional bottom-fixed turbines. As a result, the focus has shifted towards developing innovative floating offshore wind solutions to harness the country's vast wind resources.

Based on Europe's developmental experiences, the design of floating platforms, mooring system deployment, and cable equipment are pivotal for the success of floating offshore wind power projects.

Credit: BW Ideol

Professor Muk Chen Ong, a member of the Norwegian Academy of Technological Sciences (NTVA) and the leader of the Ocean Technology Innovation Cluster Stavanger (OTICS), highlighted several areas of potential work in Taiwan. They include the development of semi-taut mooring systems for shallow and intermediate waters, cost reduction strategies for the installation and decommissioning of suction anchors, and addressing navigational safety concerns, marine life entanglement risks, and the coexistence of wind, solar, wave, and aquaculture industries.

In adherence to the floating wind farm demonstration project, the Ministry of Economic Affairs has stipulated a maximum capacity of 90 to 180 MW for a single wind farm installation, equivalent to 6 to 12 floating platforms. As a fundamental guideline, two wind farms are anticipated to be made available for demonstration projects. Operators have the option to flexibly increase one wind farm based on project content, potentially resulting in a maximum total installed capacity of 540 MW. The procurement of feed-in tariffs is planned, with grid connection expected by 2029-2030.

Furthermore, developers such as Blue Float Energy, SRE, CIP, and Taiya Renewable Energy have all successfully passed the initial environmental impact assessment (EIA) review.