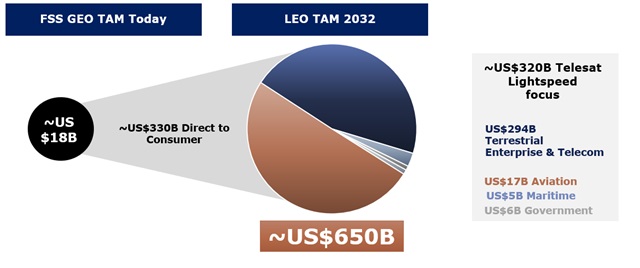

In a significant move to foster global cooperation in the field of satellite industry, Telesat embarked on a mission to Taiwan and South Korea. The Ottawa-based company is actively engaging with both corporations and government agencies to introduce its ambitious Low Earth Orbit (LEO) satellite project known as "Lightspeed Constellation," which has raised its largest fund at US$500 million.

Glenn Katz, Telesat's Chief Commercial Officer, revealed that the team had already conducted several business meetings during their stay in Taiwan. A couple of corporate meetings and discussions with various government agencies, including the Taiwan Space Agency (TASA), National Science and Technology Council(NSTC), Ministry of Digital Affairs(MODA), and Telecom Technology Center(TTC), took place to inform stakeholders about the Lightspeed project.

The 198-satellite program is set to commence satellite launches in mid-2026, with polar and global services scheduled to initiate in late 2027.

Telesat aims to provide specific and customized solutions

With its higher-altitude LEO satellites flying at around 1,300 kilometers, Telesat aims to minimize congestion and increase satellite lifespan, with satellites designed to last 11 years, compared to the five-year lifespan of some competitors. To distinguish itself from Starlink's consumer-centric model, enterprise-focused Lightspeed stands out by offering Service Level Agreements (SLAs) and Committed Information Rates (CIRs), ensuring quality and reliability for its clients.

One of the key differences is the open and flexible nature of Lightspeed. Unlike subscription-based services offered by its rivals, Telesat empowers its customers to design their networks and create a suite of services tailored to their needs. An apt comparison for Telesat's approach could be to liken it to Android in the satellite communication industry, in contrast to the more closed-loop systems, such as iOS. This open architecture fosters adaptability and customization, allowing various verticals to develop specific solutions that best suit their needs.

Glenn Katz expressed, "We're trying to utilize and maximize the ecosystem that already exists in this very robust satellite industry."

Telesat believes that Taiwan has a unique advantage in the satellite industry, primarily due to its expertise in manufacturing satellite components and terminals. "Taiwan can be a leader going forward over the next X years in the technology needed for low Earth orbit, both all the components of the satellites themselves, as well as the ground segment equipment," said Glenn Katz.

The collaboration between Telesat and Taiwanese suppliers is already in motion, with Taiwan playing a crucial role in the Telesat supply chain. "Our existing customers like CHT and Lung Hwa Electronics, there were a few other smaller companies that we started to have discussions with, mobile network operators as an example."

The team also met with companies specializing in phased array flat panel antennas and engaged with the Industrial Technology Research Institute (ITRI), which offered insights into available technologies and partnerships. Telesat aims to leverage Taiwan's talent and innovation in satellite technology, further promoting the company's collaboration with local entities.

Source: Telesat

Asian market important to Telesat, China to emerge as competitor in the market

Telesat emphasized the importance of the Asian market in its business plan. With numerous islands, mountainous terrain, and vast populations, the region offers ample room for satellite communication to serve underserved and communication-deprived areas.

"We have customers in Japan, Korea, Indonesia, Australia, India, Vietnam, and Malaysia, so we're already familiar with that area. But we have limited satellite capacity in this area. Most of those 14 geostationary satellites centered more on obviously North America and moving over into sort of Europe and Africa. Not we have one satellite and maybe one and a half that really works for this area." added Glenn Katz.

The company views this region as one of the largest and most promising markets and is determined to expand its services and satellite capacity to meet the growing demands.

When asked about China's rise in the space industry, Glenn Katz acknowledged that China, like the European Union and Russia, is keen on developing its own LEO satellite network. While competition is inevitable, Telesat sees China's LEO network as one among several competitors in the market.

Telesat anticipates competition in regions like Africa where it has a strong presence. However, it does not foresee providing services within China. The complexity and cost associated with establishing operations in China present challenges that make it a less attractive option. Additionally, Telesat has an active subsidiary in the United States, Telesat Government Solutions, which adheres to U.S. procurement rules governing foreign-owned entities. This aspect of the business may influence its market strategy.

Furthermore, Telesat's focus on cybersecurity specifications and the growing reliance on Telesat's services by the U.S. government and other governments worldwide aligns with their commitment to ensuring a robust and secure network.

Telesat's expansion into East Asia exemplifies the evolving dynamics in the satellite communication sector. As Telesat forges ahead with its plans, the global satellite market is poised for increased competition and cooperation, setting the stage for innovative solutions in the ever-expanding space industry.