Since Taiwan launched its New Southbound Policy, Taiwanese enterprises seem to be working all on their own when investing in Southeast Asia and India. But who are their competitors? There seems to be little help available that could inform their new deployment strategies from a Taiwan perspective, so we are now trying to provide that kind of help.

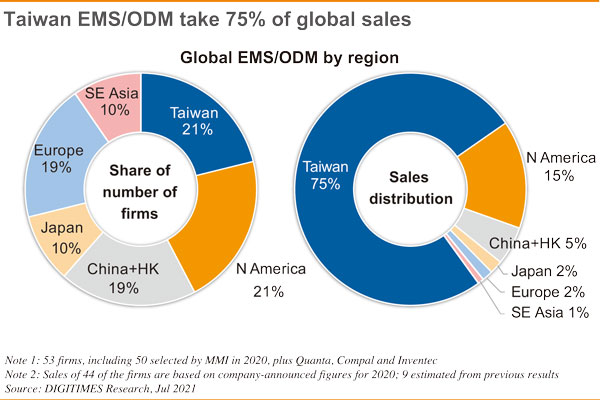

DIGITIMES has come up with a preliminary analysis of 53 companies - 50 OEM/ODM firms from MMI (Manufacturing Market Insider) and another three, Quanta, Compal and Inventec (Foxconn, Pegatron and Wistron are already on MMI's list) - baded on their revenues, profita and global deployments. According to Roger Huang, director of DIGITIMES Research, the 53 companies are from Taiwan, North America, China, Hong Kong, Japan and Europe, while Taiwanese companies account for 75% of the world's EMS/ODM companies.

Within the global EMS/ODM industry, there are nine companies with revenues more than US$10 billion each. Six out of the nine companies are from Taiwan, with Foxconn (Hon Hai) leading at US$190 billion. Foxconn, Pegatron, Quanta, Compal and Wistron are ranked as the top-5. This is Taiwan's advantage. We can also look at things from different viewpoints. When the EMS/ODM firms of Europe and the US undertake their deployments in South East Asia, they take into account locations, industry landscapes, customers, and even the structure of revenues and profits. When Taiwanese firms go beyond China, they have to be very careful. Investment projects are usually big, and these multi-billion dollar Taiwanese enterprises need to keep a keen eye and comprehend the industry ecology in order to develop solid strategies.

Interestingly though, Taiwanese businessmen prefer to collaborate with businesses in Vietnam and Malaysia, while European and American investors prefer those in Singapore, Malaysia and Thailand. Jabil, the largest US EMS firm with its 2021 revenue target of US$29.5 billion and relatively lower profit margin is to engage in a more intense race with Taiwanese firms. Others, such as Flex, Sanmina, Celestica and Plexus, instead tap high-margin markets such medical and transportation sectors. They will still be enaged in intense competition with Taiwanese companies who are diversifying their businesses. Of course, relationships among Taiwanese enterprises, which mainly take sizable orders from major international clients, are more of competitions than collaborations. It is a significant part of our studies to try to develop differentiation strategies that Taiwanese enterprises could adopt in these new areas.

(Editor's note: This is part of a series of analysis on the IT supply chain by DIGITIMES Asia president Colley Hwang.)