People who don't get used to spending time looking for information are less likely to understand the expertise and cost of organizing the primary material of raw data. Many people understand "garbage in, garbage out." If you do not know where to search for information, you are apt to deviate from the theme and end up with wasting social resources.

Instead of looking for fragmented information sources, professional consulting institutions define the scope of research in line with their advantages to serve customers. During the inception phase of MIC under Institute for Information Industry (III) in the 1980s, customs statistics were the most important reference in addition to magazines and publications. We had a good grip on each company's regional distribution of exports, sales destination, unit price, and so forth to make judgements on the dynamics and trends of Taiwan's IT industry.

In 1989, I told my supervisor at MIC - where I was working at the time - that as we had to wait for customs statistics for three months, plus one month of information compilation, the annual statistics would not be released until April. To meet the industry's needs to develop their plans for the coming year by end of the current year, we would have to finish up industry statistics in early November. At my suggestions we made adjustments: Given the export statistics of the customs from January to October, coupled with shipment forecasts of the final two months through questionnaires and surveys of the top 20 IT manufacturers, we managed to build up the statistics structure with figures of motherboards, computers and monitors. This is the origin of statistics of Taiwan's computer industry in the 1990s.

Now Taiwan has 805 publicly listed IT firms, with total revenue of US$795 billion. As long as you know how to classify them, you can track them one by one to update industry information. These data can be modularized for further analysis to capture key industry trends.

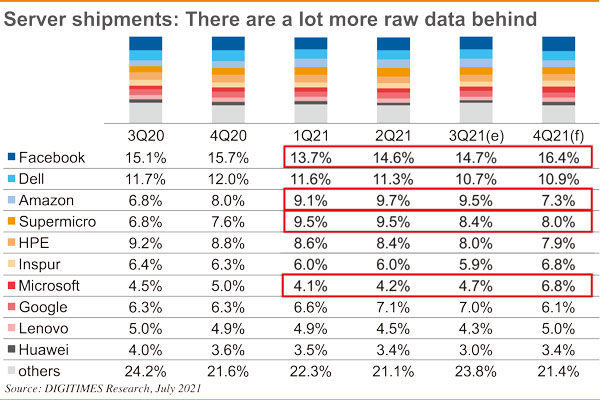

Market research agencies also develop their own approach of securing more accurate data to interpret key industry trends. For instance, in the past it was only required to estimate the next quarter's product structure, but now since Taiwan is on the frontier of the supply chain, we can select 25 categories of components each from the notebook, server, handset and other major sectors for deeper research and long-term tracking. After such data accumulate over time, it becomes the raw data that can be cross-referenced for industry research.

Raw data is the core for industry analysts to grasp the big picture of the key industry trends. With complete industry data at their disposal, analysts can integrate them based on industry dynamics and individual industry experience, and then interpret them from different perspectives. Interpreting data certainly requires professional expertise.

(Editor's note: This is part of a series by DIGITIMES Asia president Colley Hwang about industry research work.)