Before studying India's electric vehicle (EV) market, you may need to understand the Indian modes of transportation. According to NSSO, 62.3% of Indians prefer public transport such as buses and trains, and 46.7% of Indians use three-wheeled tuk-tuk. During weekdays 15.6 % of Indians regularly take trains while 9.8 % of them take a taxi. We can observe the future means of transport for Indians from the perspectives of "new technology" and "mode of operation".

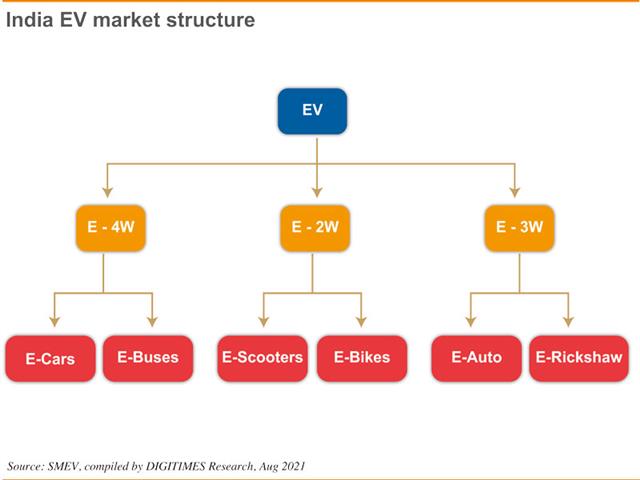

The EV sector alone can be segmented into two, three, and four wheelers which include four-wheeled passenger cars and buses. The two-wheelers include electric scooters and bikes. Three-wheeled EVs also have potential business opportunities in India, such as the popular daily transportation means of tuk-tuk and three wheelers. Each of these six different types of vehicles has its own ecosystem. Their interlaced business models are elaborate enough to bewilder interested enterprises.

The most challenging move to India is not technology per se, but commonly the business models and partner issues. What's more, cost competition has been deterring potential foreign investors. Ford's withdrawal from the Indian market is mainly because their operating costs are higher in India than in China, with India's per capita income only one-third of China. In favor of the local partnerships, the Indian bureaucracy tends to complicate the procedures that would deter foreigners.

Business models for the Indian market are complex and diverse enough to allow for unlimited creativity. With a population of 1.37 billion, India already has more than 30 unicorn companies. Foreign investors are optimistic that a creative and imaginative India will be the capital of unicorns after China.

To be efficient in the Indian market, Taiwanese businessmen should have a clear outline of business model and focus on collaboration with unicorn startups, information services and telecommunications services providers. I have talked to the top management of a Taiwan-based IT firm with mass production operations in India. I pointed out that Taiwanese businesses would be able to establish a strong foothold in India. Can the Indians bypass the supply chain established by Taiwanese or Koreans when they attempt to compete abroad? Certainly not. Then, Taiwanese businesses should not be reluctant to go to India.

Why did Ford quit? The biggest factor may be the operating cost that is higher than that in China. Actually foreign enterprises can let their local partners shoulder the operating expenses. As long as foreign enterprises keep costs under control, they may at least avoid untenable situations, though profitability may not meet their expectations.

(Editor's note: This is part of a series of analysis on India's industry and market by DIGITIMES Asia president Colley Hwang.)