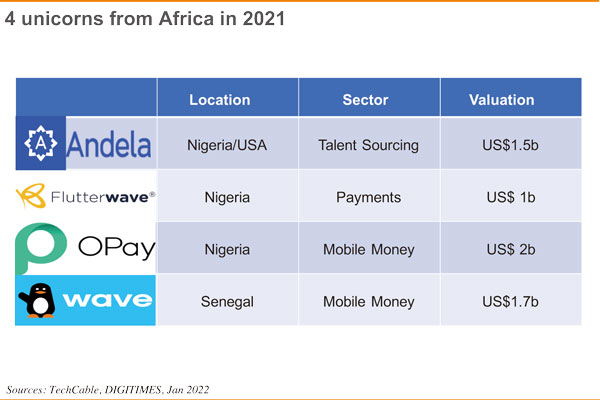

According to CB Insights, there are more than 900 unicorn companies worldwide, with seven in Africa, four of which appeared during January-September 2021. The funds collected by African startups during first-half 2021 were more than the sum accumulated during 2015-2018.

I recently met the founder of one of the unicorns. We discused the possibility of setting up an electronics supply chain in Africa. The young entrepreneur from Nigeria is in his 30s, and is described as one of the most influential people in Africa.

With a population of 200 million people, Nigeria is the most populous country in Africa, which has a population of 1.3 billion people. The annual mobile phone sales in Nigeria reached 40 million units, mostly provided by China's branded vendors, with the cheapest mobile phone sold for US$27. The entrepreneur is exploring ways to produce mobile phones and computers in Africa, and Taiwan is his first choice in search of possible partnerships.

I personally believe that decentralized production is gradually taking shape. Localized production provides employments for various countries, even if it is as simple as the assembly work. If the system can be operable in different countries and profitable to sustain everyone's livelihood, it is the decent way to run a business.

The populations in East Asian countries are ageing. With 3.4% GDP growth and 60% of its 1.3 billion people under the age of 25, Africa promises increasing significance in the global economy and culture.

In the new Internet-driven economy, the number of global unicorn companies is approachig the 1,000-benchmark. The US still has the most unicorn companies, while the share of Chinese unicorn is dropping from a peak of 24% to 18.6%, replaced by unicorns from other emerging countries.

Africa-based Opay once again successfully raised US$400 million in 2021, becoming the first company in Africa with a market value of more than US$2 billion. It took longer for unicorn companies in Africa to achieve unicorn status before 2020. Africa's most senior unicorn companies Interswitch and Fawry were established in 2002 and 2008 respectively. But the other five African unicorns spent less than five years reaching the status, with four of them spending an average of 3.75 years by 2021, indicating that Africa's model of cultivating unicorns is getting mature.

With great potential to become a unicorn enterprise, "Soonicorn" refers to a mini-unicorn business established in the recent five years with accumulated funds of more than US$100 million.

According to Antler, the average age of unicorn founders worldwide is 34. The average age of the 114 African startups surveyed is 29, with only 20% of them over 35 years old, and only 8% of them are females. These entrepreneurs have an average of eight years of work experience before starting a business. Upbeat about business opportunities in Africa, now more than 200 venture capital companies have been established. SoftBank's "Vision Fund" invested in Nigeria-based Opay. However, it is estimated that Africa only accounts for 3% of the global venture capital investment, with most of it going to finance, energy, e-commerce, as well as logistics and agricultural technology.

We are fully aware that Africa's business environment is not as good as that of developed countries. Nevertheless, young African entrepreneurs have started early and become more and more mature thanks to the widespread Internet. Although only two-thirds of the 114 African entrepreneurs surveyed are local Africans, the increasing local presence suggests that understanding the local market is getting more and more important. Many of these African startup entrepreneurs have worked in well-known companies such as Mckinsey, Google, IBM, and PayPal. Coming from Egypt, Nigeria and South Africa, many studied in famous universities in Europe or the US. Now their challenge is how to leverage the financial and employment opportunities in Africa.

India's Reliance Jio was originally a telecom company with poor telecommunications services. Through bundling telecommunications services with low-cost mobile phones, it outperformed the others to become a market leader in India. It is important for African Internet companies to demonstrate local values by leveraging hardware business. Emerging countries may have many problems, but their demographic dividends allow local businesses to explore successful business models.