At present, there are 801 publicly listed IT companies in Taiwan, with 395 in the main board of the stock exchange market and 406 in over-the-counter market. Since most of the major players have been raising operating funds through the open market, we can grasp the dynamics of Taiwan's IT industry through the released financial reports.

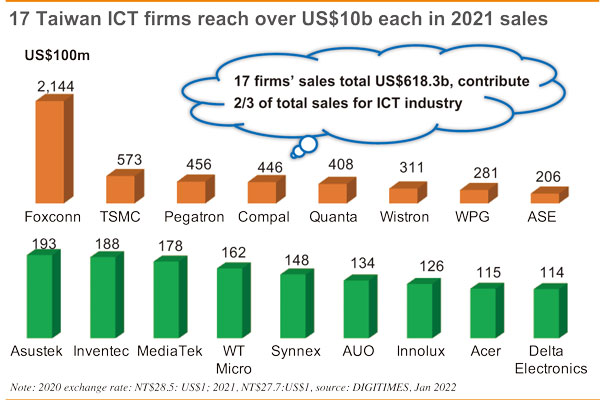

Of the 801 companies, eight of them have reported annual revenues of more than US$20 billion, and 17 of them over US$10 billion. The total revenue of the top-10 players reaches US$520.6 billion acconting for 55.4% of the industry's total revenue. The top-17 players with revenue over US$10 billion contribute 65.8% of the total industry's revenue.

The big ones getting bigger?

Only 13 companies reported annual revenue of more than US$10 billion in 2020. The new US$10-billion club in 2021 includes AUO, Innolux, Acer, and Delta Electronics whose business has been solid and stable. AUO and Innolux benefited from the booming panel market in the first half of 2021. Acer's notebook and game console businesses flourished as a result of the stay-at-home economy. Delta Electric achieved a great success with revennues exceeding US$10 billion for the first time thanks to surging demand from energy and EV markets.

It seems the big ones are getting bigger. However, industry sectors are getting more diversified. The production model of increasing diversity+scalability is taking shape, catalyzed by the interaction of IOT, EVs, and decentralized production mechanisms. The main businesses of these US$10-billion enterprises like notebook, mobile phone and server manufacturing are still undertaken by the parent companies. However, many emerging applications which require integration of software and hardware must be carried out through outsourcing, M&A, and cross-shareholding practices. Once the industry enters the maturity phase, various models of capital operation and alliance would be springing up.

What's more, everyone is keeping an eye on the formation of the EV business opportunities. Taiwan enterprises are keen on the EV businesses, but EVs or future self-driving cars do not belong to the traditional manufacturing alone. In the past, the automotive industry was monopolized by the advanced industrialized countries. Based on various reasons such as industrial development and national security, emerging countries with adequate populations or industrial bases are bound to launch industrial policies in favor of local makers and service providers. Multiple strategic alternatives would be available for Taiwan enterprises to choose from. They can produce EVs in different countries, become key partners of local EV players in supporting sectors, or ally with local service providers or/and local manufacturers.

In recent years, US presidents Trump and Biden have stressed the importance of a meaningful control of the supply chain. Under such a new US strategic goal, Taiwan's role is becoming increasingly important, and the significance of the distribution industry's deployment on the smart manufacturing, smart logistics and decentralized warehousing mechanisms cannot be overemphasized. Among the top-17 enterprises with revenue of US$10 billion, the three largest electronics distributors WPG, WT Microelectronics and Synnex are all gaining robust growth momentum. China Airlines reported a monthly profit of NT$3 billion in fourth-quarter 2021, thanks to the surging needs from Taiwan's IT industry to switch to air freight due to port congestion issues.

We anticipate that the large electronics distributors who hold huge industrial data continue to play a key role. We can also foresee that Taiwan's Taoyuan International Airport and the peripheral service providers may upgrade to the next level through digital transformation and business adjustments to usher in the next wave of industrial structure changes.