NOR flash demand has been strong demand, helping suppliers buck the seasonal trend in the first quarter. Supplier expect NOR flash shortages in second-half 2020, thanks to strong demand from the 5G, IoT and automotive sectors. In another sector of the memory industry, China's Yangtze Memory is looking to start volume production for its 128-layer NAND flash chips later this year, securing a "meaningful" role in the market. In the foundry sector, TSMC reportedly has obtained major orders for Nvidia's next-generation GPUs.

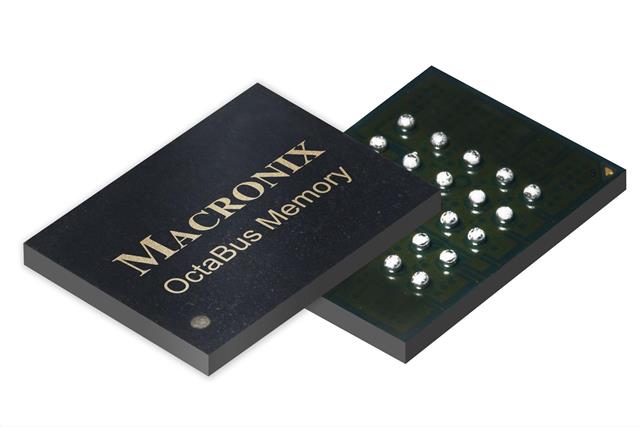

NOR flash supply likely to fall short of demand in 2H20: The global supply of NOR flash chips particularly high-density ones is likely to fall short of demand starting the second half of 2020, according to sources at memory chipmakers who already saw their NOR flash sales outperform seasonal patterns in the first quarter.

Yangtze Memory to ramp 128-layer NAND flash output in 2020: China-based Yangtze Memory Technologies (YMTC) will be striving to kick off volume production of 128-layer 3D NAND flash chips later this year, racing to catch up with its bigger rivals, according to industry observers.

TSMC obtains major orders for Nvidia next-gen 7nm and 5nm GPU, sources claim: Speculation is circulating that Samsung Electronics' 5nm EUV process has attracted orders from Nvidia for its next-generation graphics processor series, but sources familiar with the matter believe TSMC will remain the major foundry partner of the chip vendor for its 5nm as well as 7nm GPU families.