Some 38% of semiconductor market share is contributed by computing products, and around 32% from communication products. Notebooks, desktops and servers are major categories of computing products, with notebooks being the biggest of them all. Getting a good grip on notebook industry trends can give a good grasp of the bigger picture about the business climate of the computing sectors.

Taiwanese manufacturers contribute more than 80% of the world's notebooks, and for servers they have even more than 90% of the market when Level 6 barebones are taken into consideration. Taiwan plays a pivotal role worldwide. For the notebook industry, the top-6 iconic brands, Hewlett-Packard (HP), Lenovo, Dell, Apple, Asus, Acer, are core players. For servers, AWS, Microsoft and Google are the key players, and adding HPE, Dell and SuperMicro to the equation will give a clear picture of the supply and demand in the server market. Nevertheless, whether it's a notebook or server, they are forged by the manufacturing powerhouses in Taiwan, including Foxconn (Hon Hai), Quanta, Compal, Wistron and Inventec.

What's more, in order to mitigate the pressure arising out of the US-China trade war and soaring costs in China, some notebook and server production capacity has migrated to production bases outside of China. The relocating progress is also a topic of concern to be addressed. The communications sector comprises telecommunications, networking equipment and handset segments, and handsets are inextricably linked to Taiwan's industry. Taiwanese makers have first-hand information of the status of the handset supply chain, from the upstream to the downstream.

DIGITIMES Research estimates notebook shipments at 238 million units in 2021, a sequential increase of 19% over 2020. Global smartphone shipments are expected to reach 1.32 billion units in 2021 with 6.4% growth over 2020. The US-China trade war coupled with Huawei's setbacks and the pandemic have triggered supply chain disruptions such as component shortages and cannibalization. Chinese firms are hoarding crucial parts and making aggressive moves in emerging markets; and any twist will produce a new look of the maket.

The notebook market can be segmented into commercial, consumer and educational sectors. In recent years, with moderately priced Chromebooks sold like hotcakes, their shipments are estimated to have reached 22.89 million units in the first half of 2021. Chromebook sales in the US and Europe, however, have peaked and strong sales for them are now expected in Asia starting from the third quarter, with a chance to exceed 40 million units in overall sales annually, making them a variable that must be taken into account, though the commercial and consumer devices are still the two mainstream segments of the notebook market that need close monitoring. Product mixes and shipments delivery status of companies such as HP, Lenovo, Dell, Apple, Asus and Acer are the underlying factors for observation. The recent megatrends of working from home have driven the business opportunities for not just notebooks and servers, but also gaming products.

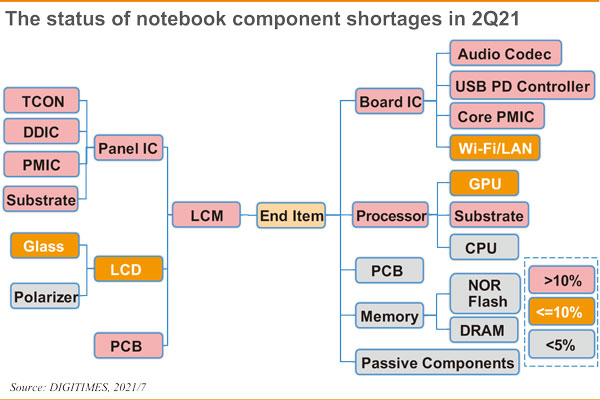

The semiconductor upstream segments have been sending out messages about clients willing to spend more securing capacity, and order visibility has extended throughout 2022. Concerns over overbooking have been alarming. Is it too optimistic to anticipate demand and supply to be in equilibrium by the end of 2021 during the off-season? A more intricate and wavering business world is assumed to bring more lucrative business opportunities, and more favorable terms, but who will be the market winner? In the diagram below, bars of components in red indicate over 10% shortage gap to fill; orange ones 10% or less; and gray less than 5%. Of course we have also prepared forecasts for the final two quarters of 2021.

(Editor's note: This is part of a series of analysis by DIGITIMES Asia president Colley Hwang about the global IT supply chain.)