A while back at a DIGITIMES-hosted seminar on the ICT industry's outlook in 2022, Tony Huang, deputy director of the DIGITIMES Research Center, pointed out that the regular safety stock levels for components distributors can be nine weeks or more. However, as of the end of 2021, the distributors of Microchip, the world's largest non-vehicle MCU vendor, kept only 21 days of inventory although the peak season had ended. If we observe the business atmosphere from BB ratio of Infineon, a major IDM, we may conclude that demand for car semiconductors produced the most fluctuations with BB ratio coming over two for three consecutive quarters. Demand for other components like power semiconductors and semiconductors for industrial control was also in high gear. Inventory records of Renesas indicated a similar trend. Apparently, the industrial climate is still on the upswing. The imbalance of semiconductor supply and demand won't be relieved in one or two quarters.

Applied Materials projects that global data flow in 2025 will be 100 times as much as in 2018. The vast majority of the data generated is not human-to-human communication, but from the contribution of smart manufacturing.

Triggered by the surging demand for datacenters, the major chip players are developing advanced processes with more powerful and faster computing specs. Ushering in the new era of DDR5 memory chips, CPU vendors have been developing products embedded with DDR5. The demand of servers will play a key role after 2022.

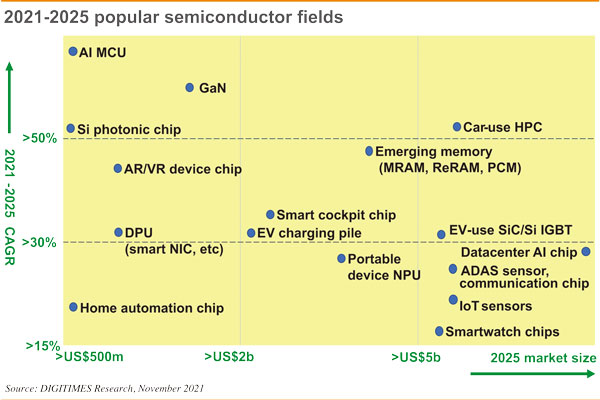

Estimating industrial growth of the next five years, the DIGITIMES Research Center projects the sectors which would perform at an average annual growth rate of more than 50% include AI-featured microprocessors, silicon photonics, high-performance computing chips for EVs, and power semiconductors (GaNs). Other promising areas with growth rates between 30-50% include chips for AR/VR devices, emerging memory solutions (MRAM, ReRAM, PCM), smart cockpit chips and semiconductors & DPUs for charging piles. Chips for smart homes, NPUs for portable devices, AI chips for datacenters, and sensors for IOT will also see considerable growth in demand.

As for the more upstream car semiconductors, the current mainstream process is 45nm technology. Once 28nm technology is adopted, the role of Taiwan enterprises will be more significant. The development echoes the expansion plans of Taiwan's leading semiconductor players like UMC, Winbond, Macronix, Vanguard and Powerchip.

(Editor's note: This is part of a series of analysis of Taiwan's role in the global ICT industry.)