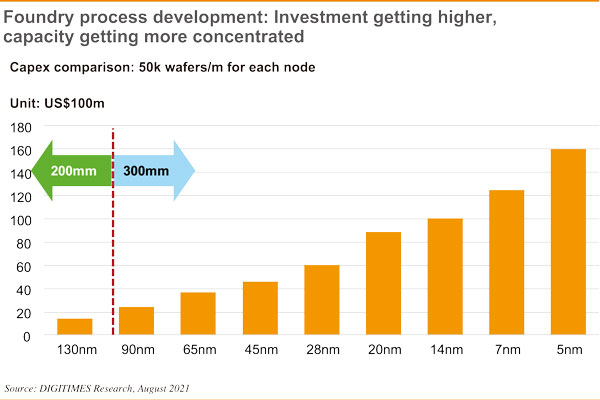

DIGITIMES estimates that it costs US$2.4 billion to build a 12-inch wafer fab using the 90nm process node with a monthly output of 50,000 wafers. The investment can reach US$6 billion for a 28nm fab and US$16 billion for the currently most advanced 5nm fab.

Since not every enterprise can shoulder such hefty investment, the concentration ratio of the industry is getting higher and higher. In the years before the 1998 Asian financial crisis, the top-5 wafer foundries accounted for about 27% of global investment. In the wake of global financial disasters in 2008 the concentration ratio rose to 58% and has now reached 72%. This is a highly capital-intensive industry, with TSMC taking the lead. TSMC's capital expenditures are estimated to reach 54% of its revenues in 2021. There have been rumors that iconic chipmakers like Qualcomm, AMD and Nvidia will shift orders to Samsung. Considering Samsung's wafer foundry revenues of less than US$15 billion, it can barely replace TSMC's role in terms of technology and capacity. Given that it is a capital-intensive industry, Samsung can take a lead in one or two process nodes or grab one or two customers at best. But overall, it can hardly pose a threat to TSMC before 2025.

Advanced process is crucial, but the supply and demand of products using mature processes has been affected due to insufficient investment. Take car semiconductors as an example. Most of them are using 45nm or more mature processes. The emerging demand may start from 28nm, but it is still difficult to reach a balance between supply and demand in the short run.

In the next few years, the growth momentum of the semiconductor industry is to remain robust. We anticipate that with increasing demand of larger bandwidth for data centers, high-efficiency chips will still prevail. The EV business opportunities are expected to bring surging demand for the semiconductor sector. The future EV has been regarded as the third mobile computer with wheels, and even a more powerful mobile server. In addition, edge computing with AI capabilities will also trigger chip demand. New design architectures coupled with technological changes are coming into play. Chiplets along with advanced packaging and test technology will be the industry's new innovation areas.

Many products using the mature processes will still be facing shortages in 2022. Spurred by a variety of innovative needs, the semiconductor market size will easily cross the threshold of US$500 billion in 2021. The US$1 trillion milestone by 2030 seems far but reachable for the global semiconductor market. Semiconductors are ubiquitous. Those who own semiconductors have the final say. The US still takes the global lead in technology, while Taiwan has unique advantages in regional markets and specialty areas that have attracted much global attention.

(Editor's note: This is part of a series of analysis of Taiwan's role in the global ICT industry.)