Britain, France, Germany and even India have all announced national policies to accelerate transition to EVs between 2030 and 2040. Cities from Paris, Rome, Athens to Mexico City, all set their target dates to phase out fuel-powered cars. Taiwan must be well prepared by 2025 to usher in the era of EV.

Hsin-I Lin, a senior advisor to Taiwan's president, pointed out that Taiwan's annual carmaking output value reached a peak at NT$220 billion in 2014, and it was NT$190 billion in 2020, with export of automotive parts exceeding NT$200 billion. Lin projected that the output value of the automotive industry could reach NT$600 billion, and it would'nt be a surprise that it would become another trillion-Taiwan-dollar industry in a few years.

Lin seems to be relatively conservative as compared with Foxconn (Hon Hai) chairman Young-Way Liu, who has foretold that Foxconn will unleash its EV business expansion in 2023. Yancey Hai, chairman of Delta Electronics, has noted Delta is about to usher in remarkable growth. He must be upbeat about car- and energy-related businesses rather than the traditional IT businesses.

But what is the market penetration rate for different EV transport modes? Citing Bloomberg's data, UMC co-founder John Hsuan highlighted electrical SUVs and trucks accounted for only 1 % in 2020, with passenger cars more than 4%, battery-powered buses 39%, and two-wheeler as high as 44%.

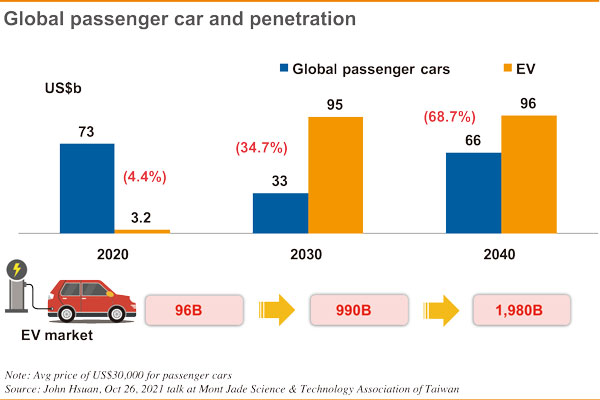

Take passenger cars for example. Globally, electrical passenger car sales of 3.2 million in 2020 accounted for a penetration rate of 4.4%. It is projected that 33 million new EVs will hit the road by 2030, with a penetration rate close to 35%. At least two-thirds of the world's passenger cars are EVs by 2040. The global market size will grow from US$96 billion in 2020 to US$990 billion in 2030 and US$1.98 trillion in 2040. All global IT players certainly have their hearts set more on the EV industry with market size of US$2 trillion than the PC industry of US$300 billion and handset industry of US$600 billion.

The battery sector now dependent on foreign vendors is "the last piece of the puzzle" to complete Taiwan's automotive supply chain. Hsuan believes that Taiwan's yearly market size of 400,000 vehicles should be enough to prop up a battery company. A sustainable battery industry coupled with a super grid of recharging infrastructure are the trends and desirable applications of Taiwan society.

With structural transformation of the vehicle market and industrial transition, expectations of Taiwan's strengths in electronics and machinery industries from multiple countries are rising. Business opportunities are knocking at the door of Taiwan's electronics industry.

(Editor's note: This is part of a series of analysis of Taiwan's role in the global ICT industry.)