The development of the ICT supply chain over the past 30 years has only been paving the way for the next golden decade of Taiwan!

Ever since Compaq's sharp price cuts in 1992, plus penetration into the Japan's closed PC market by DOS V, the US and Japanese PC brand vendors began to place OEM orders with Taiwan makers. The scale of Taiwan's PC industry expanded by 10 times between 1992 and 1996. When I served as the deputy director and later director of the Market Information Center (MIC) at III and was put in charge of the statistics for the entire Taiwan information industry, I witnessed the inception of a wonderful era.

It has been exactly 30 years since Taiwan undertook OEM businesses in 1992, coincided with China's reform and opening-up, when government subsidies, economic and technological development zones, demographic dividends were all in place. Notebook production had all been transferred to China by 2000. Coupled with the rise of smartphones after 2007 and catalyzed by multiple factors, the global ICT industry supply chain, fully-compliant to the iconic vendors, were steadily expanding.

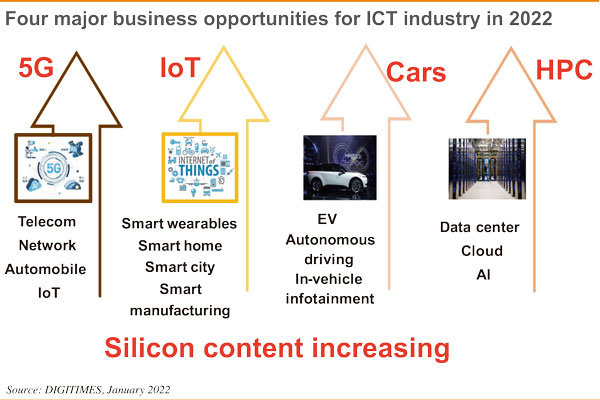

But I assume this is just a warm-up period for the global supply chain. We are likely to usher in a golden decade of Taiwan's ICT industry starting 2022 with new business opportunities triggered by diverse global changes.

The demand for mobile phones and PCs remains robust. Given the relatively stable supply chain and market, coupled with the variables under the G2 conflict, the number of emerging strong players is limited in the area of mass production. On the other hand, with the formation of a decentralized production system, the affiliation and division of labor between Taiwan enterprises and local leading IT players in Asia and North America will be another important trend. We believe that unicorn companies in India, ASEAN, and even Africa will seek partnership with Taiwan enterprises. To rebuild its supply chain, North American players cannot do without Taiwan. I often stress that Taiwan is a harmless partner who can provide highly efficient supply chain as well as convincing know-how and experiences to emerging countries eager to establish their own mass production mechanisms.

For Taiwan enterprises, business opportunities of the future cars and smart city should involve local partnerships. I wouldn't encourage Taiwan enterprises to invest resources in emerging industries or businesses that have little interaction with Taiwan. But I do think that it would still be a good business by selling shovels during the gold rush.

Google invested in industrial computer maker Ennconn to become its third largest shareholder next to Foxconn (Hon Hai) and Fubon, which marks the start of Internet giants' investments in Taiwan's supply chain. Taiwan makers have re-shored production back to Taiwan with accumulated investment funds of NT$1.5 trillion targeting at huge industrial control business opportunities boosted by smart manufacturing.

The strength of the IPC industry is its "diversified production." It is conceivable that Taiwan's IPC firms with mass production capability are to experience a great wave of booming businesses. Not only do IPC firms identify new business opportunities, Taiwan's top IT manufacturers are all keeping an eye on the latest development. Some players may be watching opportunities of in-car computer and electronic control systems or even participate in the upstream race of the third-type semiconductor. With increasing complexity in the manufacturing process, Taiwan enterprise are in a more favorable position to differentiate themselves from other overseas players and avoid head-to-head competition.

For Taiwan enterprises, the future challenges include not only diversified mass production, but the definition of their own business models, marketing strategies and deployments.