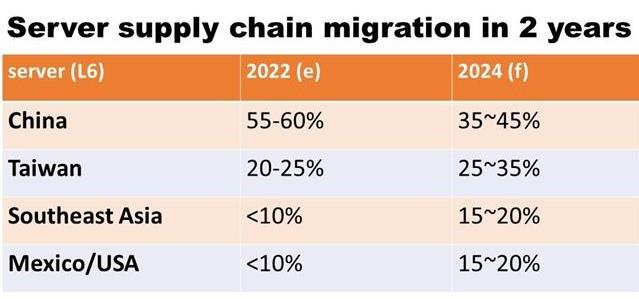

The US-China trade war, decarbonization, and geopolitical factors have been the driving forces behind a partial migration of server production lines out of China to Taiwan, Southeast Asia, and North America. The growing presence of Southeast Asia and North America in the server manufacturing sector is especially significant.

Nearly 60% of the world's servers have been produced in China in 2022, but the percentage actually had already decreased from 70-80% before the US-China Trade War, according to DIGITIMES Research.

"Taiwanese server manufacturers Inventec and Quanta moved part of their server supply chains back to Taiwan in 2019 in the heat of the US-China Trade War, and the trend of diversifying capacities out of China continues," said DIGITIMES Research server analyst Frank Kung, who estimated that China's share of global server output may drop to as low as 35% by 2024. He said Southeast Asia and North America will see their server production grow by 2024.

Read more: Stories based on DIGITIMES Research reports

"Main server clients such as Amazon, Microsoft, Google, and Meta all have their largest market in North America, and therefore it is reasonable to migrate some of the production lines to America and Mexico," said Kung. "Foxconn Technology Group has already established production centers in the US and Mexico to cut transportation costs as well as to meet the demand of its customers."

Other server manufacturers such as Quanta Computer and Wiwynn have also decided to move some of their production lines to Thailand and Malaysia, respectively, said Kung. "Foxconn is also studying the feasibility of producing servers in Vietnam, according to supply chain sources," he said. Meanwhile, Mitac Holdings has also announced that it will expand its production capacity in Southeast Asia without specifying the country where its factory will be located.

"Localization and regionalization will be a global trend of no return," said Kung, emphasizing that the demand for low latency in data transmission, and data sovereignty and protection of sensitive data as required by regulators are important factors for server manufacturers to produce near the markets.

Source: DIGITIMES Research; credit: DIGITIMES Asia

The trend of hybrid cloud, which requires the combination of cloud and the edge, cannot do without the deployment of the edge, and that requires servers close to the users. The other key factor is the decarbonization requirements of the clients, including the cloud service providers and the brand-name original equipment manufacturers (OEM), who all want to keep their carbon footprints as low as possible.

"Although the percentage of servers produced in Mexico and America is only in the single digits right now, it will continue to grow in the next few years," said Kung. He estimates that by 2024, about 15-20% of the servers will be produced in North America, up from less than 10% in 2022.

About the Analyst:

Frank Kung has an MSc degree in Technology Innovation Management and a bachelor's degree in electrical engineering. He has accumulated more than 10 years of research and project management experience at an industrial PC firm, the Institute of the Information Industry, etc. Currently, his main research areas include the server industry and application market observation, such as HPC, AI, data center, and edge computing development trends.