China's satellite industry is expecting a high-growth period driven by an increasing number of application scenarios, especially in the mobile and automotive sectors. Entering 2024, Chinese smartphone brand Oppo, for instance, revealed its Find X7 Ultra with direct satellite communication ability in early January, while Xiaomi is expected to release its first phone with two-way satellite connectivity, Xiaomi 14 Ultra, in the first quarter of 2024.

Chinese carmaker Geely, meanwhile, plans for a 240-satellite constellation known as Geely Future Mobility Constellation, with the first phase of 72 satellites to be launched into low earth orbit (LEO) by 2025. The constellation will be made up of communications, remote sensing, and communication satellites. Apart from serving Geely's autonomous driving project, the constellation also targets logistical, mapping, drone navigation, and other applications.

According to data provided by the GNSS & LBS Association of China, the total output of China's satellite navigation industry was CNY500 billion in 2022, a 6.76% growth compared to 2021. Specifically, about 376 million end devices using Beidou navigation were sold in 2022, with 264 million of them being smartphones, and more than 12 million on automobiles. The association also estimated that 14,000 companies were active in the industry as of 2022, with 92 of them listed in Chinese stock markets.

Chinese satcom industry still in the in-orbit trial stage

However, when it comes to satellite communication, one Chinese observer noted that China's satcom industry is still in the in-orbit trial stage, and a complete constellation akin to that of Starlink has not taken shape. Remote sensing satellites traditionally dominated China's space program: as revealed by the data gathered by AVIC Securities, as of April 30, 2022, out of 541 active Chinese satellites in orbit, 55% were remote sensing satellites (296), 12% were communication satellites (67), and 9% were for navigation (49). In the same period, thanks to SpaceX, out of 3449 US satellites, 78% were for communication (2692),15% were remote sensing (510), and 1% were for navigation (34).

The proportion will soon change though with various Chinese companies planning their satellite internet constellations, especially the 12,922 satellites planned by the state-owned Guowang (GW) and the equally prominent G60 mega-constellation that also aims to launch about 12,000 internet satellites before 2026-2027. An estimation by AVIC Securities predicts a 15-20% compound annual growth rate (CAGR) for China's overall satellite communication industry between 2021-2025, with the markets for satcom equipment and satcom service reaching CNY11 billion and CNY14 billion, respectively. For satellite navigation, AVIC estimates a CAGR of 20%. As for remote sensing, a CAGR of 40% is expected, with the market size surpassing CNY30 billion in 2025.

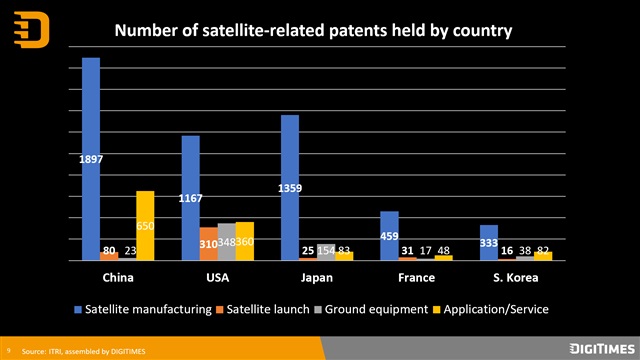

To date, in line with global trends, China's focus on the satellite industry is more concentrated on satellite manufacturing, as indicated by the Intellectual Property Innovation Corporation (IPIC) under Taiwan's Industrial Technology Research Institute (ITRI). As of 2023, according to IPIC, China had 1897 patents on satellite manufacturing, representing 72% of total satellite-related patents held, followed by 650 patents related to satellite service/application - a figure significantly higher than that of the US, Japan, France, and South Korea. It also reveals a potential way for the Chinese satellite industry to play catchup: via innovations in satellite-related applications and services that will in turn inform its own technological developments - a strategy China often adopts in other sectors.

Credit: DIGITIMES

Antenna and semiconductor breakthrough key to scale-up?

Further cost reduction and production scale-up will be the main challenge to overcome. By 2025, for example, the city of Shanghai aims to build an industry capable of pumping out 600 commercial satellites and 50 rockets per year. In this process, as a Huawei insider told Chinese media IT-Times, breakthroughs in antenna and integrated circuit technologies are prerequisites. Allystar Technology, a main domestic contender in China's Global Navigation Satellite System (GNSS) chip market, nevertheless acknowledged that in-house chip design poses multiple difficulties and 60-70% of the Chinese GNSS chip market remains dominated by foreign suppliers. Sun Zhonglian, Allystar chairman, highlighted the difficulty of customizing on-chip algorithms for a wide variety of application scenarios - a challenge not encountered in smartphone baseband chip design - and that also led to a longer development cycle for GNSS chips.

Apple's failed attempt to design its own 5G baseband chip already shows the high entry barrier of baseband chip design. For Project Kuiper, Amazon is also designing its baseband chips for both satellite and ground gateway applications under the codename Prometheus, and it remains to be seen how it will work out.

Despite these known obstacles, Chinese companies like Geespace, Geely's space-focused subsidiary founded in 2018, still took on the in-house development of high-precision GNSS chips, in addition to developing a 22nm-based SoC integrating both RF and baseband chips to be used in smartphones and vehicles. Alongside AI and automotive chips, it seems that the satellite industry will be another front of China's chip autonomy endeavor.