Samsung sold nearly 300 million handsets in 2019, a number Samsung regards as its last line of defense, hoping to sell no less than 300 million handsets a year to sustain its business development. For every node in its wafer foundry business, Samsung has targeted mainly the mobile communication sector, which also renders Samsung the best opportunity of breakthrough. However, contrary to expectations, Samsung's share of the Chinese handset market has plunged to less than 1%, and in the Indian market Samsung is facing strong challenges from Xiaomi and Vivo. In order to maintain competitiveness in pricing, outsourcing to Chinese makers has become an option. It is estimated that about 60 million Samsung handsets are manufactured by outsourcing partners.

With a languishing business, Samsung has apparently adjusted its operation guidelines by moving two-thirds of its handset manufacturing business to Vietnam and one-third to India. Vietnam is the most preferred location for manufacturing because the Southeast Asia country and South Korea have established a long-term strategic partnership, and the Vietnamese government provides attractive tax incentive packages. On top of that, parts and components from China's suppliers in Guangdong and Shenzhen can also be transported by land all the way to the northern regions of Vietnam. In northern Vietnam, where Samsung has two handset production sites, its low-cost, abundant and young workforce is one of the reasons Samsung prefers Vietnam.

Samsung is not entirely a competitor of Taiwan

Interestingly, Taiwan and South Korea were once engaged in a legal battle over their panel businesses, but there seems to be some subtle changes in their relationship as of late. Samsung and LG have already dismissed traditional LCD panels as their strategic businesses, and outsourced production and purchasing from outside sources have become their main options. Once described by Taiwan's panel makers as their bitter foe, Samsung now is a big client of AU Optronics (AUO). There may be no true friendship in business competition, but there are no rivals that cannot be reconciled. When they need each other, they can shake hands and make peace.

Revenues from Samsung's IM division with handset as its core business could exceed US$100 billion, but it contributes only about a quarter of the company's profits. Thanks to a favorbale cycle of demand from the semiconductor sector during the past two years, Samsung has been able to sustain its overall profits and revenues. But what about 2022, 2023 and even 2030? How will Samsung deploy and manage its post-pandemic operations?

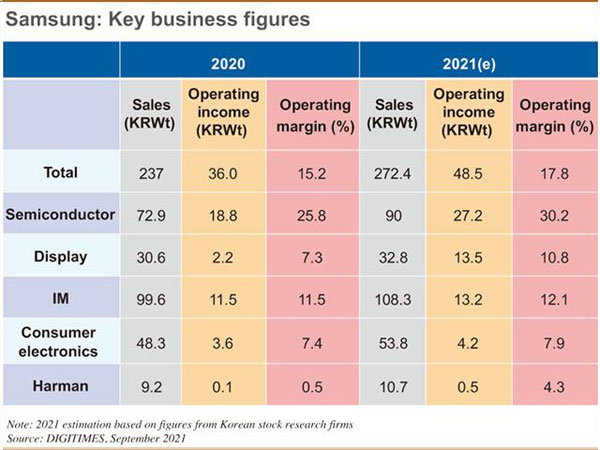

The rivalry between Taiwan and South Korea is diminishing, but the chances of forming a "star alliance" with members complementing each other are growing. (The name of Samsung in Chinese literally means "three stars.") Samsung's operating income is expected to increase from KRW36 trillion in 2020 to KRW48.5 trillion n 2021, up by 34.5%, with its profit margin climbing to 17.8% in 2021 from 15.2% in 2020. The operating profit of the key semiconductor division has again exceed 30%, which has laid a solid foundation for Samsung to engage in active deployments.

In the past, Taiwan and South Korea saw very similar paces in industrial development, with the pair engaged in more competition than cooperation between them. But in the last decade or so, new coopetition relationships have evolved. After 2009, Samsung's mobile phone division has become a strong pillar of the company's business, while Taiwan's HTC has become almost obsolete in the handset market. Without competition in the brand device market from Taiwan, coupled with fact that Samsung's mobile phones in recent years have encountered keen competition from Chinese brands, Samsung has been relying more on Taiwan businessmen due to cost concerns. Samsung has now become a big client of Taiwanese firms, and it is estimated that MediaTek will supply 37% of the application processors that Samsung handsets will use in 2021.

In the display sector, Samsung and LG have given up LCD panels as a strategic business since 2010. Initially they would only outsource production of panels in the size segments that they weren't good at. But they have now vowed to stop production of LCD panels. Although they have postponed plans of terminating LCD panel production for another year in response to market conditions in 2021, it is obvious that the two Korean panel players are just trying to make the most of the residual value of their technologies and equipment before retiring them. When a department is no longer the focus of a business, it is conceivable that the deployment of talent, and resources are likely to be brought to an end at any time.

The panel industry had handsome profits during the first half of 2021 because of the shortage of panels with profit margins increasing from 7.3% in 2020 to more than 10%, but the panel business is actually flagging. The South Korean firms are increasing outsourcing and outside procurement on the one hand and eyeing the opportunities from system integration on the other. Once the market is saturated, or when the competition is squeezing margins, Samsung will adjust its pace to specialize in more sophisticated, high-value-added areas, otherwise it will be overwhelmed by its own "operating expenses" over time.

Samsung and Taiwan have been undergoing diverse and dynamic changes. I'm sure that the number of Taiwanese businesses in Samsung's ecosystem can form a "star alliance." Coopetition relationships in the world of business are difficult to defined in just a few words.

(Editor's note: This is part of a seies of analysis by DIGITIMES Asia president Colley Hwang, focusing on Samsung with comparisions of the IT industry developments in Taiwan, South Korea and China.)