While Russian troops were bombing Ukraine, a US delegation led by Michael Glenn Mullen, ex-chairman of the joint chiefs of staff, arrived in Taiwan, followed closely by a separate visit by former US secretary of state Mike Pompeo. Taiwan has never received such high-profile attention since it withdrew from the UN 50 years ago. Some attribute the dramatic change to the blessings of Taiwan's "sacred mountain range" – the semiconductor firms that locals believe are protecting the country.

To give a holistic view of the future semiconductor industry, DIGITIMES just released a 2022 semiconductor industry report to further explore the impact of geopolitics on the semiconductor supply chain and the possibility of co-opetition among the major countries and companies in the race. The following is the abstract of the whole report.

The semiconductor industry is likened to "nuclear weapons" in global politics. Without massive nuclear weapons, Russia, with total GDP lower than that of South Korea, would not be strong enough to invade Ukraine, let alone deter the West from imposing a no-fly zone over Ukrainian territory.

So far, the US, Taiwan, South Korea and Japan account for 82% of the global semiconductor production capacity, while China represents 60% of the global market demand. This is in line with the fact that 61% of the semiconductors exported by Taiwan and South Korea went to China in 2021.

However, it is prone to bias if we observe the industry by referencing solely the manufacturing capacity of wafer foundries. We need to take into account the most upstream sectors like EDA/IP design tools, materials, equipment as well as backend packaging and testing, and even components distribution. If you look at the market side, you need to understand which brand vendors deliver products to the end market and how brand vendors can be divided into IDMs (integrated device manufacturers) and fabless IC design houses. Supply chain players in the global race are not limited to companies from the US and Taiwan; major firms from South Korea, Japan, and Europe are also very active. The rise of Chinese enterprises is complicating co-opetition among all players. There are many different dimensions to such intricate relationships being reshaped by different market opportunities.

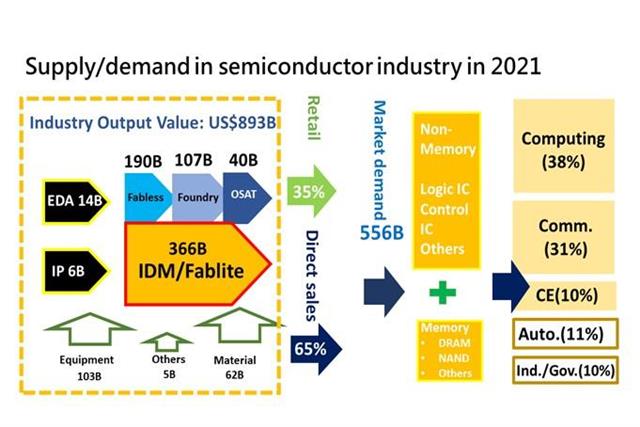

Basically, we look at the semiconductor industry from two dimensions: the market side and the supply side. The market side includes IC design houses and IDMs that sell their own-brand products into the market. Well-known IDMs include Intel, Texas Instruments (TI), Infineon, Renesas, Rohm, Samsung and Taiwan's Winbond, Macronix, Nanya Technology and others. IC design houses include Nvidia, Qualcomm, AMD, and Taiwan's MediaTek and Realtek. According to the Semiconductor Industry Association, the combined revenues of global IDM and IC design houses in 2021 reached US$555.9 billion – the total of the global semiconductor market in 2021.

But the output of US$555.9 billion actually involves a lengthy process across various sectors (see diagram below). In general, instead of going the whole nine yards, design houses and IDMs look for support from design tools (EDA) and intellectual property (IP) companies to accelerate the product design process and reduce costs. Upstream suppliers of design tools and IPs contribute about US$21 billion a year of the total output.

Upon completion of the product design work, they have to confirm the fabrication processes with the wafer foundries. The IP rights and experience of the foundries play an integral part in mitigating development risks for the design houses and the brand vendors. The global wafer foundry market has just exceeded the benchmark of US$100 billion, reaching US$106.6 billion, of which the biggest Taiwan-based foundry accounts for the highest share.

The processed wafers are then delivered to the packaging and testing plants, which had a global output value of US$39.7 billion. Taiwanese companies occupy more than half of the global market share in this sector. In recent years, China's packaging and testing sector has become the world's second-largest force next to Taiwan through mergers and acquisitions. Basically, each area requires its own specific know-how and it is almost impossible for any individual company to assume all tasks or for any country to integrate all manufacturing sectors. This has been a tremendous challenge ever since China started building a semiconductor industry on its own.

Source: DIGITIMES Research, March 2022

Editor's note:

DIGITIMES 2022 semiconductor industry report explores the impact of geopolitics on the semiconductor supply chain and the possibility of co-opetition among the major countries and companies in the race. The whole report is divided into two parts – Part 1: Geopolitics may bring dramatic shifts in semiconductor industry and Part 2: Will Taiwan, South Korea, and Japan join semiconductor alliance with US, exclusively for DIGITIMES' registered members.