Is Samsung Electronics going up or going down? I'm not talking about the stock price, but rather the competitiveness of Samsung.

For the past few decades, Samsung has been the main competitor of Taiwanese companies, but now, except for its rivalry with TSMC in the foundry sector, Samsung has been purchasing electronics products massively from Taiwanese suppliers. Why? What is its future outlook? UMC, AUO, netcom equipment makers, and module makers who buy a lot of memory from Samsung - they should should be very concerned about Samsung's future strategy.

Not long ago, the boss of a company in the IT industry told me that Samsung's memory business was going downhill and would be surpassed by Micron. Will that become reality? However, some argue in favor of Samsung: It is a world leader in terms of technology, production scale and brand recognition, but its stock price and market capitalization are not the same as those of other companies in the same class. They say Samsung deserve better.

What companies are considered in the same class as Samsung? Apple, TSMC, Intel? Compared to these world-class companies, what are Samsung's strengths and weaknesses? I wouldn't predict Samsung's future by intuition. We must first set a framework of research, compare the latest industry information, and find out the signs of changes. I am going to share my thoughts on these in a series of 10 articles.

Samsung has been outstanding in marketing, positioning itself as a high-end brand for smartphones, TVs, and telecom equipment. It also offers high value-added services to boost its international status and secure world-class partners. Samsung bought Harman in 2017 for US$8 billion, aiming to strengthen its position in the multimedia and automotive market segments.

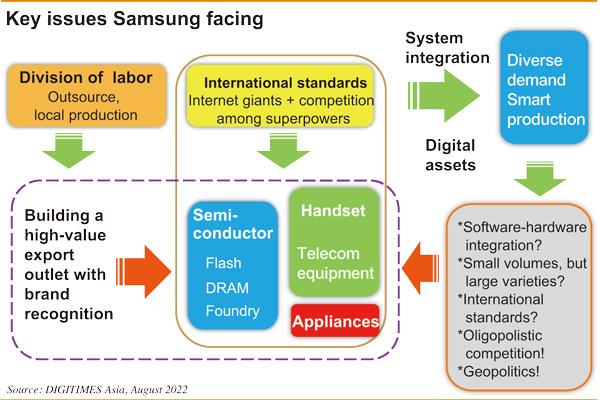

But has the Harman acquisition been a success? Will Samsung, which has kept its cash on hand at around US$100 billion over the past few years, make up for its shortcomings with acquisitions? The industry standards and the winning formulas are changing; the competition under the G2 (US and China) structure, and the strategic layouts of the Internet giants are forming the future industry framework. Samsung actually plays a crucial role in determining whether South Korea will join the Chip 4 alliance.

The competition that Samsung is facing is no longer the kind that it has seen in the past from Taiwanese or Japanese companies; but rather it involves the highest level of international strategic deployments. It is the political power of the US and China that forms the framework; and Japan, Taiwan and South Korea - none of them are first-tier competitors. If you want to have a share of the world's top-tier business opportunities, the national strengths are essential. The South Korean yearn to boost their national strengths, but that is no easy task.

Secondly, companies may think they can rely on smart manufacturing to satisfy demand for software-hardware integration and production in small amounts of a large variety of products. But localized production and multiple division of labor may stand a better chance of becoming mainstream in the ecosystem than smart manufacturing. How can Samsung, which is accustomed to complete upstream-downstream vertical integration, adjust its business strategy?

As a Taiwan-based industry analyst who has long observed Samsung's ups and downs, I would like to look at the key issues that will affect Samsung in the next 10 years from a different perspective.

(Editor's note: This is part of a series of 10 articles by DIGITIMES Asia president Colley Hwang about Samsung's outlook.)