It is an established national policy of the US to rebuild the local semiconductor supply chain. US secretary of state Antony Blinken and secretary of the treasury Janet Yellen have both emphasized that the reliance on Taiwan for over 90% of the most sophisticated semiconductor chips is a national security issue for the US. But not allowing semiconductors to become a "silicon shield" will also be a national security issue for Taiwan.

In the US-China confrontation, semiconductors have already become a powerful counterweight to China's rise, leaving Taiwan with no other choices. And consolidating Japan and South Korea in the Western camp is imperative. The US, Japan, Korea, and Taiwan together account for 92% of the world's semiconductor output value, and the US expects the four countries to team up to advance semiconductor technologies in the Chip 4 framework.

Of the US$555.9 billion global semiconductor market in 2021, US vendors contributed US$273.9 billion, or 49%, followed by South Korea (17.3%) and Taiwan (9.7%). The influence of Korean products, thanks to the dominance of Samsung and SK Hynix in the memory market, exceeded that of Taiwan.

However, if we look at the total industry output value of US$894.3 billion with production activities included, the US still tops the list with US$359.5 billion and a 40.2% contribution rate, while Taiwan, with its outstanding capabilities in wafer fabrication, packaging, testing, and IC design, accounts for 17.3%, higher than South Korea (14.8%), which focuses on memory, and Japan (10%), which has not made much progress in recent years. In terms of total industry output, the US, Japan, Korea, and Taiwan together account for 82%.

In terms of IDM and IC design, the US is still the leader; in terms of memory, South Korea is the dominating force; and Taiwan, despite its limited resources, has gained an overwhelming advantage in the foundry sector, allowing all kinds of high-end processes to take root in Taiwan, which is also a bastion for the US to stop China from gaining cutting-edge manufacturing capabilities.

For the US, Taiwan is definitely on its US side; but South Korea is a different story. In addition to Samsung's NAND plant in Xi'an and SK Hynix's DRAM plant in Wuxi, South Korea sells 60% of its semiconductor products to China. Economic problems are unlikely to immediately crush South Korea, but it won't easily give up its strategy of leveraging China to counter threats from North Korea.

But the situation is getting out of hand for South Korea. The deputy commander of the US forces in Korea has vowed that in case of conflicts in the Taiwan Strait, the US would use its military bases on the Korean Peninsula to provide Taiwan with assistance. The commander of the US Army has also stressed that US forces in Korea would participate in military operations in the Taiwan Strait. Even South Korean president Yoon Suk-yeol has had to promise his country would use all diplomatic means to mediate tensions in the Taiwan Strait.

At the end of the day, the economy and industries all serve political purposes. When the US decides to use semiconductors as a non-military counterweight to China's rise, Taiwan and Japan will have no choice, and South Korea will be no exception. And if war breaks out in the Taiwan Strait, none of us will be unscathed; nor will Japan and South Korea.

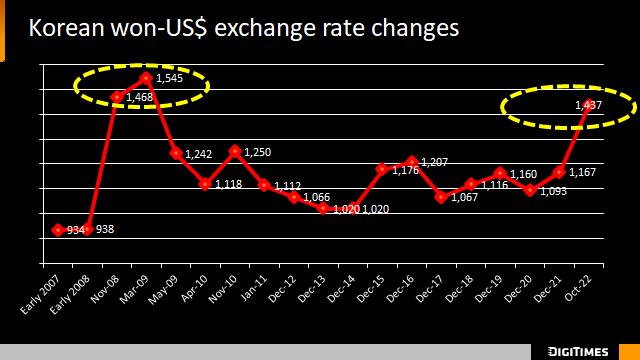

Until China has enough power to counterbalance the US, the world will remain a unipolar one dominated by the US - at least it will be so in the Western camp or in capitalist societies. And the US armed forces in Korea and the Korean semiconductor industry are just a few pieces of the bigger picture of the US-China confrontation. In addition, the weak financial structure of South Korea underlies the continuous depreciation of the Korean won. If South Korea is to find itself in trouble again, can it expect help to come from China or the US? At this critical moment, ideology will be the key to the reshaping of the Asian topography.

Credit: DIGITIMES Asia, October 2022

(Editor's note: This is part of a series of articles that revolves around the issues of the US-China confrontation, but focuses on the problems that Taiwan, Japan, Korea, ASEAN, India and other emerging Asian countries have to face in their industrial strategies and ICT supply chains.)