As national security and supply chain security have become crucial issues amid the US-China trade war and the COVID-19 pandemic, semiconductor manufacturing capacity has also become a key focus of government policies.

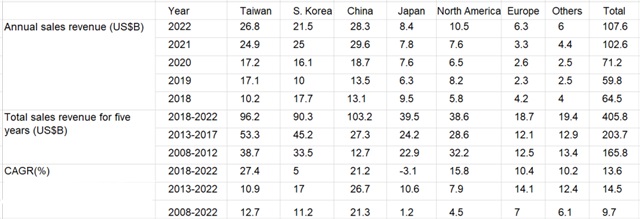

Against this background, the global semiconductor equipment market witnessed an unprecedented breakthrough in size for two consecutive years in 2021 and 2022, surpassing the US$100 billion mark. The market size reached US$102.6 billion in 2021 and US$107.6 billion in 2022.

Based on the original data released by the Semiconductor Equipment and Materials International (SEMI) and the Semiconductor Equipment Association of Japan (SEAJ), the structural changes in the semiconductor industry can be traced.

It can be seen that Taiwan, South Korea, and China are the largest semiconductor equipment markets in the world, accounting for over 70% of the global market from 2020 to 2022. Although China began to list semiconductor as a strategic industry and established manufacturing plants such as SMIC and HSMC in 2000, the scale of investment and plant construction was not considered significant globally until the release of the "Outline for Advancing the National IC Industry" in 2014. It was then that the industry's momentum truly picked up when massive investments were made in various segments of the semiconductor supply chain.

In 2018, China surpassed US$10 billion in market size for the first time, becoming a major market alongside Taiwan and South Korea. In 2021 and 2022, the market sizes of these three regions exceeded US$20 billion.

In North America, Europe, Japan, and other regions such as Israel and Singapore, procurement of semiconductor equipment picked up from 2020 to 2022, but there is still a significant gap compared to Taiwan, South Korea, and China.

If we look at the total equipment sales from 2018 to 2022, we can see how actively China has been procuring equipment and building manufacturing capacity, despite the impact of the US-China trade war.

While investment from the US and Japan has increased, they still lag far behind Taiwan, South Korea, and China in terms of scale. The investment momentum in Europe is even weaker compared to the US and Japan.

Examining the revenue structure of the top three semiconductor equipment manufacturers, Taiwan, South Korea, and China each account for 24%, 17%, and 28% of the revenue of Applied Materials for the fiscal year 2022 (November 2021 to October 2022). They also account for 19%, 16%, and 23% of the semiconductor business revenue of Tokyo Electron (TEL), with China being the largest market in both cases.

It can be inferred that the export control measures implemented by the US in October 2022, followed by the Netherlands and Japan, will have an impact on semiconductor equipment manufacturers. ASML, a leading provider of advanced lithography equipment, has Taiwan as its largest market, accounting for 38% of its revenue, followed by South Korea at 29%. China accounts for only 14% and is relatively less affected.

In May 2023, Japanese Prime Minister Fumio Kishida invited leading semiconductor industry players to gather at the Prime Minister's official residence in an attempt to strengthen the semiconductor supply chain. After the United States launched the "Chips and Science Act" in 2022, as of May 2023, over 300 companies have applied for subsidies, and the director of the Chip Research and Development Office responsible for managing the chip R&D program has assumed office in June.

Observing the semiconductor equipment market in recent years, Taiwan, South Korea, and China still have a high growth momentum in terms of capacity and future sales. However, with strong support from the US, Japan, and Europe, various regions have gradually established more comprehensive semiconductor industry chains. In the context of the international trend of "deglobalization," Taiwanese companies are facing the challenge of "internationalization." If they can pass this test, it can be an opportunity for further growth!

Source: SEMI, SEAJ. Assembled by DIGITIMES

Editor's note: Eric Huang currently serves as a Vice President of DIGITIMES