Despite China's weak smartphone market, Apple's iPhone series has performed relatively well in 2022 and 2023, even seeing a slight increase in market share. The reason, however, could have less to do with the iPhone's performance and more to do with China's struggling economy which has led to a sales decline of mid- to low-end models, according to DIGITIMES Research.

As the global smartphone market slowly recovers from a rough 2022, one of the key markets to watch is China, which accounts for more than 20% of smartphone shipments worldwide. Despite seeing some improvements, China's smartphone market in 2023 is still expected to see a decline, albeit in the single digits compared to the double-digit decline in 2022.

DIGITIMES Research senior analyst Luke Lin pointed out that China's smartphone market has been on the decline for several years, even when other markets were benefiting from the pandemic economy. A major reason for this is China's weak economy, resulting in issues like a high unemployment rate of 15-20% among the younger population (ages 16-24). A high unemployment rate means that many of them are without an income, causing them to be much less willing to buy new phones.

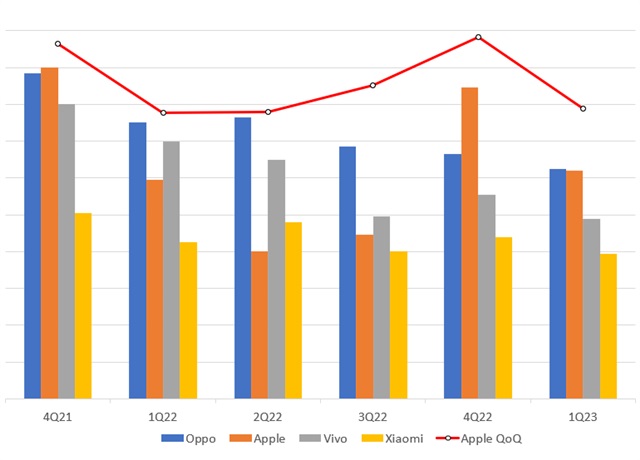

However, in the face of all this, Apple's iPhone series has maintained a relatively stable performance in the Chinese market. Though it has been affected by the decline of the smartphone market as a whole, it has stood its ground much better compared to local Chinese brands.

"iPhone sales in China always peak in the fourth quarter, right after Apple announces its new product for the year in the fall," said Lin. As an exchange, Chinese brands tend to overtake Apple from the first to third quarters. However, in the first quarter of 2023, due to delayed orders from the previous quarter, likely stemming from the lockdowns at Foxconn's Zhengzhou factory, iPhone's quarterly performance is on par with the first quarter of 2022 despite the slacking market.

Smartphone sales performance in China by brand (4Q21 - 1Q23, in m units)

Source: DIGITIMES Research

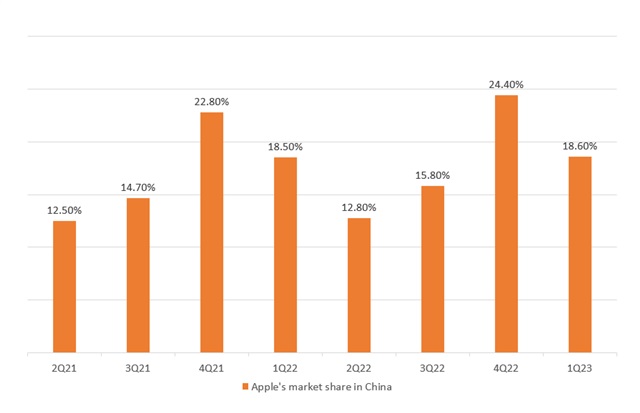

A contributing factor to this is where the weak economy has hit the hardest. China's high unemployment rate is a result of manufacturing job losses from the geopolitics-fueled supply chain migration to countries like India and Vietnam. The population most affected by this shift are those in rural areas and with lower incomes. When reflected in smartphone sales, it meant a decrease in sales of cheaper mid- to low-end models.

iPhones, however, are mostly high-end models that are much less affected by this. With Samsung having serious struggles in the Chinese market (less than 1% market share), iPhone is currently the sole international brand that still has a significant market share in China, dominating the high-end market.

Furthermore, Lin pointed out that because mid- to low-end models are experiencing a tough sales situation, it has resulted in the market share of the iPhone actually going up despite a lack of significant sales increases, reaching a peak of over 24% in 4Q22.

Apple's share in the Chinese smartphone market (2Q21 - 1Q23)

Source: DIGITIMES Research, February 2023

About the analyst

Luke Lin graduated from National Taiwan University with an MBA and BSc degree in Electrical Engineering. He is the chief smartphone analyst at DIGITIMES Research, covering the smartphone supply chain and applications. His research interests also include the geopolitical influence on the ICT supply chain, the re-globalization of electronics supply chains, and the strategic positioning of technology firms amid US-China competition.