The tide of working from home has dramatically boosted the PC industry. The notebook industry has experienced rebounds from their past moderate years. Handset vendors instead seem to be drained of creativity, and it may not be easy for them to see a repeat of the prosperity in 2008-2018. Global shipments in 2021 are projected at 1.32 billion units, a moderate rise of 6.4% year-on-year.

The COVID-19 pandemic has been heaping much pressure on manufacturers who have had to monitor employees' health on the one hand and market changes on the other. The handset industry originally expected the pandemic to ease during the first half of 2021, and market demand to rebound in the second half. In China, the handset market did see improvements in May and June compared to the first quater, but shipments in June turned out to be worse than projected. Will the boom continue in the second half of the year?

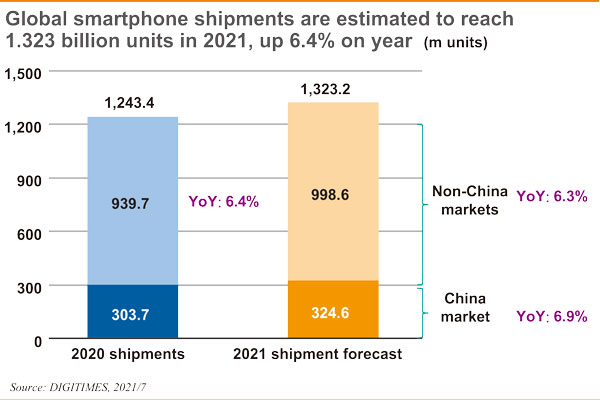

Global smartphone shipments once reached over 1.4 billion units annually but were trimmed to 1.243 billion units in 2020, thanks to COVID-19. But they are predicted to make a rebound to 1.323 billion units in 2021. DIGITIMES splits China from other markets when conducting surveys and estimates of the global handset market. China's rapid economic rise in recent years enabled a pre-pandemic global handset market share of over 30% for the country. China's handset industry, hitchhiking on surging domestic market demand and leveraging their partnerships with Taiwan-based suppliers, has earned a pivotal role in global sales and production. As such, it is justifiable to separate the Chinese market from the rest of the world when trying to understand the Taiwanese business community's moves to capitalize on the business opportunities from the Chinese market and the global rollout by Chinese brands.

DIGITIMES estimates sales volume in China's smartphone market at 304 million units in 2020, accounting for 24.4% of the global total; and 325 million units in 2021 for a 24.5% share. China's share is now hardly on a par with its big time of over 30%.

Over the past few years, Chinese vendors have been expanding overseas as a result of a saturated domestic market. They have achieved remarkable success in emerging markets such as India. Chinese brands have even hit jaw-dropping shares, reaching over 60% of the global total in the second quarter of 2020. Seven of the top 10 brands come from China. Apple's share has been bolstered by loyal iPhone fans; but in the Android camp, Samsung once claimed 20% of the market in China but now has less than 1%, dramatically outraced by its agile Chinese counterparts.

Samsung has migrated its production bases to Vietnam and India, and shifted its marketing endeavors to more affordable models. But it has only achieved limited success, making it even more challenging to safeguard its annual bottom-line shipments of 300 million units. It is estimated that the annual volume may shrink to some 280 million units, and the proportion of the flagship S-series may dwindle, which will also weaken its bargaining chips in talks over contract-manufacturing Qualcomm's processors.

Afflicted with US-China tensions, Chinese branded handsets have been boycotted in some countries, and supply-demand of parts has also been distorted by political disturbance. It remains to be seen if Huawei, which once showed strong ambitions to unseat Apple and Samsung, can manage to ship 40 million units a year. Huawei has spun off its Honor brand, and is seeking to launch a vertical market segmentation strategy to fight a way out in China. The collaboration between Huawei and telecom operators to introduce their own-brand handsets is also worthy of attention.

Xiaomi, Oppo and Vivo have problems of their own. In order to secure parts and components, Chinese handset manufacturers have maintained high levels of inventory. The supply chain community is also very concerned about how the crunch status quo will evolve.

Views from Taiwan (5): Who is the top dog to hit a big time for 5G handsets?

Colley Hwang, DIGITIMES, Taipei

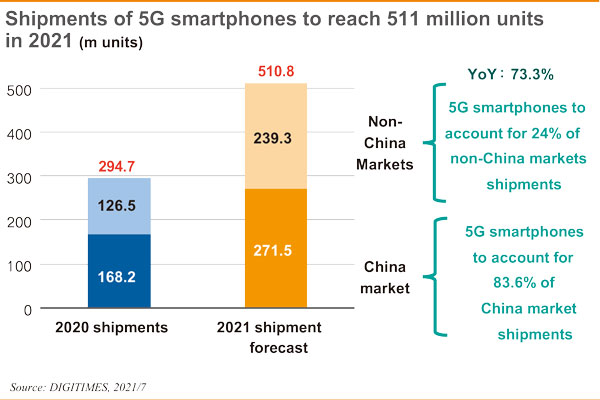

Following the 5G commercial launch, 5G handsets have experienced a surge in shipments since 2020, and China is the foremost market in terms of volume, keeping other countries at bay.

According to DIGITIMES' survey, global sales of 5G handsets amounted to 295 million units in 2020, accounting for 23.7% of the global smartphone shipments. The Chinese market alone contributed 168 million units, accounting for 57% of the global total. Global 5G hadnset shipments are projected to reach 510 million units in 2021, with an on-year growth of 73.3 %. Even though the Chinese market share will slightly slip to 53.1%, it is still a jaw-dropping proportion.

The Chinese market accounts for more than half of the global 5G smartphone market, thanks to the Chinese government's advocacy of domestic demand supporting local industries. In the wake of US-China trade frictions, China is expecting to leverage its huge domestic market to attract foreign investments, and keep close ties with IT manufacturers. The 5G infrastructure and environment are key platforms for creating supreme value for the Chinese market.

However, under the pressure of worsening US-China relations, Didi Chuxing's severe setbacks have inevitably deterred Chinese startups from going public in the US. According to CB Insights, as of early July 2021, there are 750 unicorn companies in the world, but the proportion of Chinese companies has dropped from 24% in the past to 21%. Following the Didi incident, European and American investors will naturally reevaluate Chinese companies in the Internet services sector. If China cutting off the way for Chinese companies to raise funds, or cutting off the way for corporate funds to leave the country?

The Chinese government undoubtedly is constructing more surveillance and control of networking activities. A centralized government will never tolerate private enterprises like Alibaba who is seeking to establish a tight relationship with 600 million people through electronic payment and online lending. This is two sides of a coin. Greater tolerance granted for private companies may stimulate greater business leeway and invigorate companies and industries. More conservative measures - such as setting the upper limit for the number of netizens, and regionalizing businesses - will avoid resources from being monopolized, but they will forfeit the huge business opportunities that China's 1.4 billion population may bring. Policymaking is a double-edged sword. It is the biggest responsibility and privilege of policymakers to make the most valuable strategic judgments at different times.

Metcalfe's Law tells us that more network nodes fetch higher market value. But once the government puts ceilings on enterprises, business is constrained to develop within the fixed framework, triggering a relapse to what Chen Yun - an influential Chinese communist official - called "bird cage economy." China's dilemma is ubiquitous, and we are observing the trends in China and the world from the best perspective.

(Editor's note: This is part of a series of analysis by DIGITIMES Asia president Colley Hwang about the global IT supply chain.)