Is there any way out for Huawei, which has been cornered by the US government? It used to be able to ship 200 million handsets a year, and it remains to be seen whether it can make it to 40 million units in 2021. Is Huawei going to give in? Will China let Huawei fight alone? By no means!

China's key telecom operators, or even state-run enterprises, reportedly have been launching their own-brand handsets. We can't help but wonder where these phones come from. There is no proof that they are actually Huawei-made phones, but it is reasonable speculation that it is a Huawei ploy for survival.

Huawei has already spun off its Honor brand, which was the vendor's top-of-the-line handset series. Honor is expected to sell over 40 million smartphones in 2021. Honor phones come with GMS (Google Mobile Service) and are sold in markets outside the Five Eyes alliance.

China's handset market is becoming saturated, and competition has become keener than ever. Marketing at all costs by key brands has boosted 5G smartphone sales. Following the COVID ordeal in 2020, China's major phone makers are longing for a rebound in 2021, with ample resources to fund their promotions in 2021. However, the market is still slow along with a high level of inventory, regardless of the promotional initiatives in May. Evidently, the momentum in the Chinese phone market is not strong enough to forge a solid rebound. Since local phone manufacturers are holding around two months of inventory, we are barely upbeat about the market in the second half of 2021.

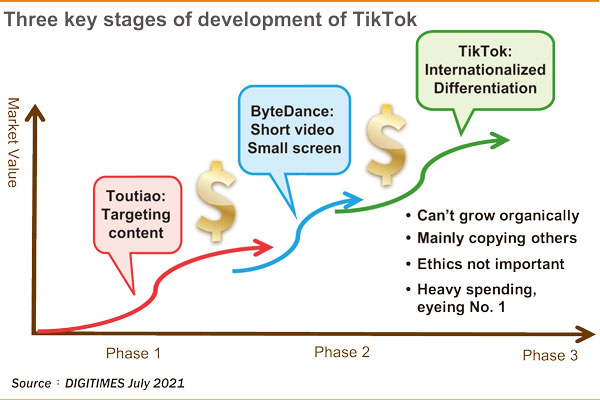

On top of that, the Chinese phone market tends to be proactive and leading all other consumption sectors. When I was studying the rise of TikTok, I tracked it from "Toutiao" - which literally means "today's headlines" in Chinese - all the way down to " ByteDance," only to find that in the enormous Chinese market, everyone keeps an eye on the B2C business opportunity. News roundup webpages like "Toutiao" can hardly fascinate investors if they are not among the best. The best way to gain market share is to spend big.

Distributors would help download apps to handsets and get CNY2 (US$0.31) for each downloaded app in return. If each phone comes with 50 apps, a retail store which sells 100 phones per day may earn up to CNY10,000 every day. China even has a unique "content farm" business model. The Chinese market is large enough for them to collect thousands of "like" clicks on specific brands for creating brand awareness, which is not an organic growth model. Nothing is impossible as long as you are willing to spend a fortune. Top rankings coupled with capital investment help to elevate confidence in developing new services. Toutiao, ByteDance and TikTok altogether have exemplified the array of exceptional Chinese practices which are blessed with demographic dividend arising from its 1.4 billion population.

This is a unique Chinese busines model: Consumers care only about good prices; and consumer rights protection and taste don't matter. This is the key to Chinese phones' dominance in the emerging markets.

(Editor's note: This is part of a series of analysis by DIGITIMES Asia president Colley Hwang about the global IT supply chain.)