US former President Donald Trump, in a Fox News interview, accused Taiwan of taking away American's semiconductor business. Despite this criticism, Taiwan ought to justify its standing by drawing upon historical precedents with dignity, virtue, and confidence.

The shift of semiconductor manufacturing from the US to East Asia commenced in the 1980s. Samsung and Hynix entered the scene in 1983, while Taiwan's UMC was established in 1980 and TSMC in 1987. These major players all started from humble beginnings and persevered through challenges to earn their success. As a veteran with nearly four decades of experience in researching ICT industries, I am well aware of the significant milestones in the semiconductor sector and understand the basis for Trump's grumbles.

At the outset, both Taiwan and Korea were regarded as second-tier players in tech industry. Given their overall industrial strength, merely having a place in the tech sector was already a noteworthy accomplishment. Both countries owe some gratitude to the United States for the "U.S.-Japan Semiconductor Agreement" signed in 1986. This agreement compelled Japan to allow foreign companies to hold a market share of over 20% in Japan, thus limiting Japanese companies, which held over half of the global market, and offering Taiwan and Korea's semiconductor industries a great opportunity.

Following the agreement in 1986, Taiwan and Korea surged ahead, securing their positions as emerging industrial nations over the next two decades. Korea excelled in memory chips, while Taiwan focused on wafer foundry services, gaining significant advantages, with over 90% of high-end chips being produced in Taiwan.

Moreover, in 2008, the subprime mortgage crisis and the global financial crisis presented an opportunity for Taiwan and Korea in 2008. At that time, Taiwanese memory chip manufacturers faced significant debts of up to 400 billion NTD (approximately 13 billion USD) to banks, and Korea's Hynix and Japan's Elpida were also in precarious situations. Samsung then played the strategy of investing during market crashes and investing heavily in memory chip production, widening the gap with other peers. As a result, Taiwan's memory chip industry lagged behind, Elpida went bankrupt and ceased operations, and even Hynix was acquired by the profitable SK Group and rebranded as SK Hynix, leading Samsung Electronics and SK Hynix to dominate with a two-thirds market share globally.

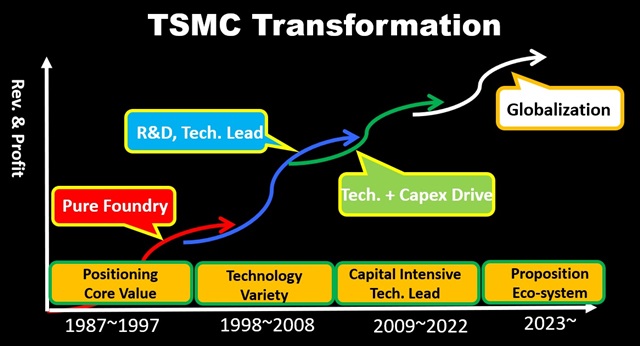

Credit: DIGITIMES

Taiwan's situation in 2008 mirrored Korea's to some extent. Morris Chang, as honorary generalissimo of Taiwan's semiconductor industry, who called himself a "learning curve believer," once again took charge and went all-in: he made substantial capital expenditures to compete globally during that challenging period.

In light of the heavy investments made by Taiwan and Korea, American equipment manufacturers also benefited. Hence, one might wonder why Trump is expressing dissatisfaction about the situation.