Backend firms including ASE Technology, Greatek Electronics, Lingsen Precision Industries and Orient Semiconductor Electronics (OSE) continue to enjoy strong packaging demand for MCUs used in diverse applications ranging from consumer electronics, medical care to automotive electronics, according to industry sources.

The backend houses have seen their wire-bonding capacity fully booked for processing MCUs and other chips through early 2022 as international automotive MCU vendors have joined Taiwanese peers to vie for their packaging capacity support, the sources said.

The OSATs are all enforcing capacity expansions, but their efforts are being affected by long delivery lead times of over six months for wire-bonders from equipment suppliers including K&S, the sources said, adding that K&S reportedly has stopped taking orders as even ICs needed for the equipment are also falling short.

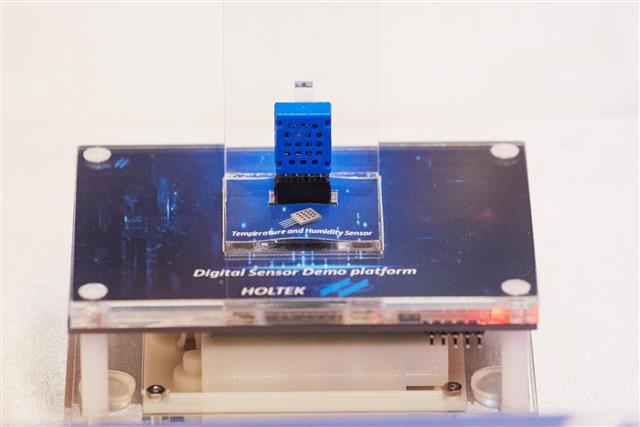

Meanwhile, Taiwan's MCU vendors including Holtek Semiconductor, Sonix Technology, Hycon Technology, Generalplus Technology, Nyquest Technology, Padauk Technology and Nuvoton Technology have all moved to raise quotes to reflect increased foundry and packaging costs and address ever-rising demand for image processing, medical measurement, and consumer applications.

Among them, Holtek, Generalplus and Sonix are enforcing a second wave of price hikes seeking out clients that can really bring robust order and profit momentum for them.

Some MCU vendors are starting talks with backend partners for capacity support in 2022, but they will have to first secure foundry capacity before obtaining packaging support, the sources said.