Asia's manufacturing-centric countries are keenly aware of their core clients' net zero goals. Carbon reduction is not a future-to-do task but has been progressing under slippage of timeline. At the forefront of carbon neutrality trends, Apple vows to achieve the goal by 2030 and completely decarbonize its packaging materials from 2025. HP sets its carbon neutrality target by 2030 and reach "net zero" by 2040. Dell plans to buy more renewable energy accounting for 75% of total energy sources by 2030 and to adopt 100% clean energy by 2040. Intel stresses that PC manufacturing needs to achieve carbon neutrality by 2030. A multiple of Taiwan's leading IT makers also have announced their strategic goals of carbon neutrality to echo the global trends.

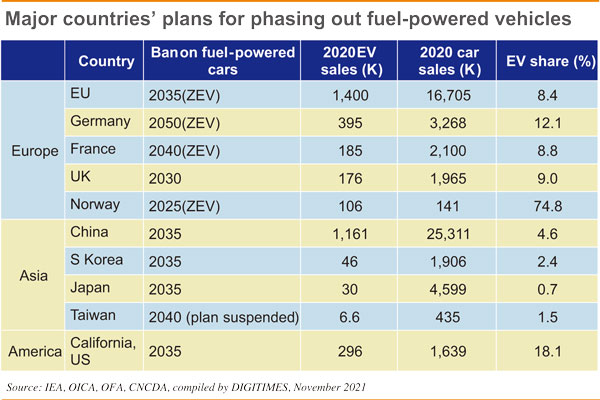

Transport is a key area to address. According to the US Department of Energy, 29% of US carbon emissions in 2020 came from the transport sector, while the UK and EU came slightly lower at 27% and 24%, respectively, and Japan at 17% thanks to its well-developed mass transit system. In any case, through the adoption of EVs to reduce carbon emissions has been the consensus of many countries. What's more, the visionary linkages of EVs with future V2X services would ease traffic issues. Consequently, many countries have set phase-out timelines for fuel-powered cars. Most of the phase-out targets are set at 2035, demanding that BEVs and PHEVs combined represent 60% of passenger cars and more than half of heavy-duty trucks electrified by 2030. However, there are substantial gaps in achieving individual timeline targets among countries. Having a significant part of North Sea oil field, Norway has taken the global lead with a remarkable success in achieving EV penetration ratio as high as 75%.

Furthermore, a slew of countries are beginning to set emissions standards for passenger cars. The EU stipulates 95 grams per kilometer as carbon emissions standards, which is equivalent to the emissions level of 24 kilometers per liter for fueled vehicles. Niven Huang, general manager of KPMG Taiwan, in a recent talk gave his Audi e-tron EV with emissions about 122 grams per kilometer as an example. The carmakers selling vehicles inconsistent with the emissions standards will be obliged to pay high carbon taxes in the future

Despite the components shortage, demand for EVs continues to be in high gear with annual output expected to grow from 3.8 million units in 2021 to 16.5 million units in 2026, with an average annual growth rate of 35% over the next five years. China has performed outstandingly with EVs accounting for 12% of 1.1 million cars sold in the first half of 2021. Besides Tesla's big gains, China's SAIC-GM-Wuling Automobile outpaced all brands with accumulative sales of 180,000 cars.

In addition to China, Germany has spared no effort to support EV uptakes and has raised subsidies twice in 2019 and 2020. It is projected global market share of German cars is to remain around 10% in 2021. Since Joe Biden became US president, his administration has introduced more ambitious policy portfolios. Alongside pouring in US$174 billion to support EV development, it announced on the White House website that the US would regain control over the supply chain of large-capacity batteries. In the first half of 2021, 250,000 new EVs were sold in the US, representing 3% of sales share nationwide, with California having the largest share of new EV ownership. Tesla is the global EV market leader with 15% market share.

(Editor's note: This is part of a series of analysis of Taiwan's role in the global ICT industry.)