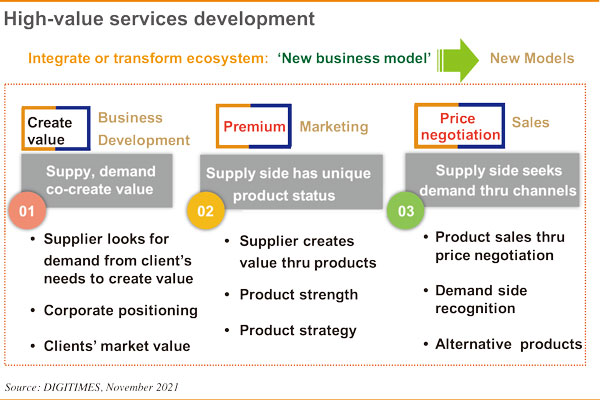

In the past, the survival model of the ICT industry was relatively simple: As long as enterprises managed to become members the Apple or "Samsung supply chain, they could secure lucrative business. Under the US-China trade war of today's world, where decentralized production mechanism and smart applications prevail, the structure of added value is changing. Owing to the changes of industrial structure and roles, there leave a great difference and room for imagination to adjust pricing strategy. For many of those who used to vie for OEM orders, the new era offers many new opportunities. In the process of industrial restructuring, manufacturers need to learn how to gain a foothold in the market to put a premium on products or services.

A while back in a banquet speech at the 20th anniversary of Monte Jade Science and Technology Association of Taiwan, TSMC founder Morris Chang mentioned that "business model" is the privilege of entrepreneurs. Those entrepreneurs who can change or grow with the ecosystem to create a new business model accepted by society can define the best price and market position. Besides running new businesses, sophisticated entrepreneurs can get a leg up through smart investment and strategic initiatives to keep competitors at bay. Chang has remarkably instilled in customers' minds an image of "TSMC only" which allows next generation of entrepreneurs to chew over the nature of entrepreneurship.

The next best alternative is for enterprises to work together with core customers to explore added value for a new win-win partnership. For instance, DIGITIMES can facilitate Taiwan's IT industry to penetrate the EV market and create new value for customers. Well aware of White House's goals to regain control over the global supply chain, we help key enterprises identify and exploit their values in supply chains to win premium benefits. We estimate that the market size of EVs alone can be up to US$2 trillion by 2030. Or as former UMC CEO John Hsuan said: if you're not a key player by 2025, you are out of the picture in the EV business. With new positioning and high-potential new market opportunities, enterprises are happy to gain a foothold in the virgin market. High expected returns suggest enterprises are more willing to pay the front money, which promises suppliers better opportunities and profit margins. Once both sides are willing to funnel in resources and make all-out efforts, the chances of collaboration are certainly higher.

The third level is marketing through which suppliers create a special position and value awareness for its own products or services with various initiatives to convince customers to pay "premium" prices. For instance, we compile daily news and research reports to provide the most complete database for the ICT industry. Since this service model is unique, customers can't compare it with offers of other providers. They are willing to pay a higher price because of relatively higher "customer perceived value." This helps the company to bring premium benefits.

The traditional business model, on the other hand, relies solely on the first-line sales force since product substitution is high. To boost product sales with pricing, the dialogue between the two sides often end up with price negotiations. The profits can be considerably eroded. This is my experiences of tackling price issues and observing how enterprises can respond in the face of a turning point. This echoes what Morris Chang said: You may recruit 1,000 engineers to improve the efficiency by 1%, but a good CEO who helps the company to define the right positioning and pricing would bring benefits far more than 1%.

(Editor's note: This is part of a series of analysis of Taiwan's role in the global ICT industry.)